Question

Suppose that a stock is currently worth $64, and each month its value either goes up by 25% (with probability 2/3) or goes down

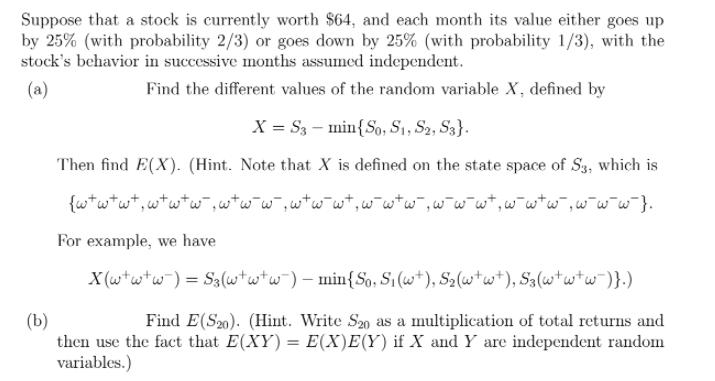

Suppose that a stock is currently worth $64, and each month its value either goes up by 25% (with probability 2/3) or goes down by 25% (with probability 1/3), with the stock's behavior in successive months assumed independent. (a) Find the different values of the random variable X, defined by X = S3- min{So, S1, S2, S3}. Then find E(X). (Hint. Note that X is defined on the state space of S3, which is {w*wtw+,wtw+w,wtw-w,wtwwt,wwtw,www*,w ww,www}. For example, we have X (wtwtw) = Sa (wtwtw) min{So, Si(w+), S2(wtw+), Sa(wtw+w)}.) (b) then use the fact that E(XY) = E(X)E(Y) if X and Y are independent random variables.) Find E(S20). (Hint. Write S20 as a multiplication of total returns and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a There are a total of 222 8 possible paths here The computations her...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

A Pathway To Introductory Statistics

Authors: Jay Lehmann

1st Edition

0134107179, 978-0134107172

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App