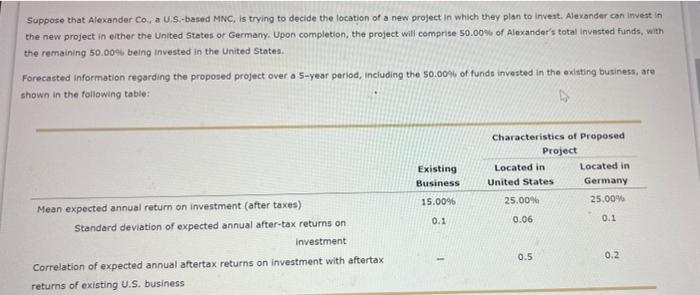

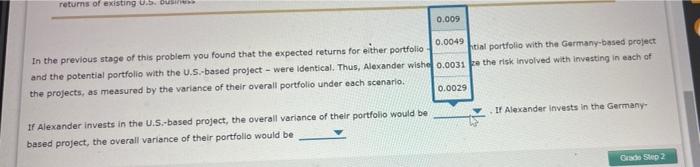

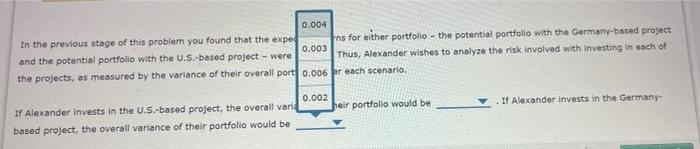

Suppose that Alexander coa U.S.-based MNC, is trying to decide the location of a new project in which they plan to invest. Alexander can invest in the new project in either the United States or Germany, Upon completion, the project will comprise 50.00% of Alexander's total invested funds, with the remaining 50.00% being invested in the United States. Forecasted Information regarding the proposed project over a 5-year period, including the 50.00 of fundt invested in the existing business, are shown in the following table: Existing Business 15.0096 Characteristics of Proposed Project Located in Located in United States Germany 25.00% 25.00% 0.1 0.06 0.1 Mean expected annual return on investment (after taxes) Standard deviation of expected annual after-tax returns on investment Correlation of expected annual aftertax returns on investment with aftertax returns of existing U.S. business 0.5 0.2 returns of existing U.b. Bu 0.009 0.0049 In the previous stage of this problem you found that the expected returns for either portfolio htial portfolio with the Germany-based project and the potential portfolio with the U.S.-based project - were identical. Thus, Alexander wishe 0.0031 the risk involved with investing in each of the projects, as measured by the variance of their overall portfolio under each scenario. 0.0029 If Alexander invests in the Germany If Alexander invests in the U.S.-based project, the overall variance of their portfolio would be based project, the overall variance of their portfolio would be Cade Step 2 0.004 In the previous stage of this problem you found that the expe Ins for either portfolio - the potential portfolio with the Germany-based project and the potential portfolio with the U.S.-based project - were 0.003 Thus, Alexander wishes to analyze the risk involved with investing in each of the projects, as measured by the variance of their overall port 0.006 pr each scenario. If Alexander invests in the Germany 0.002 If Alexander invests in the U.S.-based project, the overall varit heir portfolio would be based project, the overall variance of their portfolio would be