Answered step by step

Verified Expert Solution

Question

1 Approved Answer

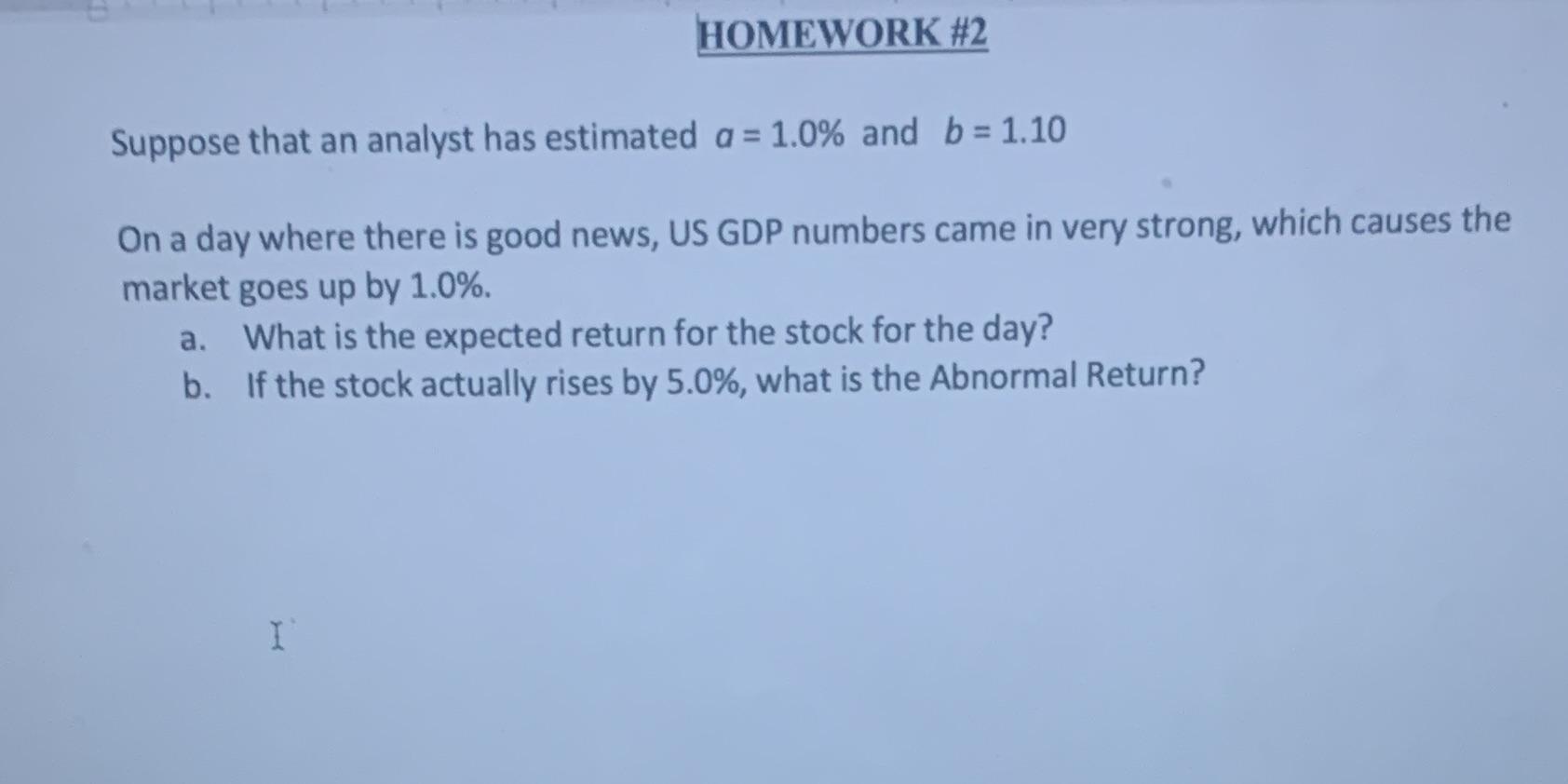

Suppose that an analyst has estimated a = 1.0 % and b= 1.10 On a day where there is good news, US GDP numbers

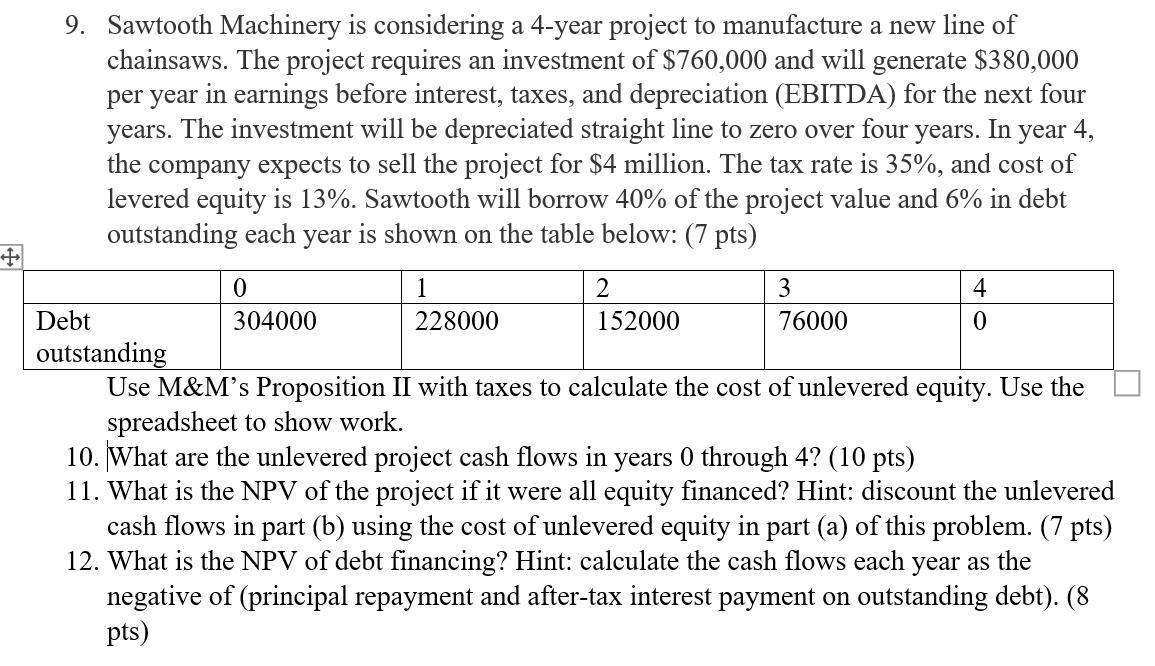

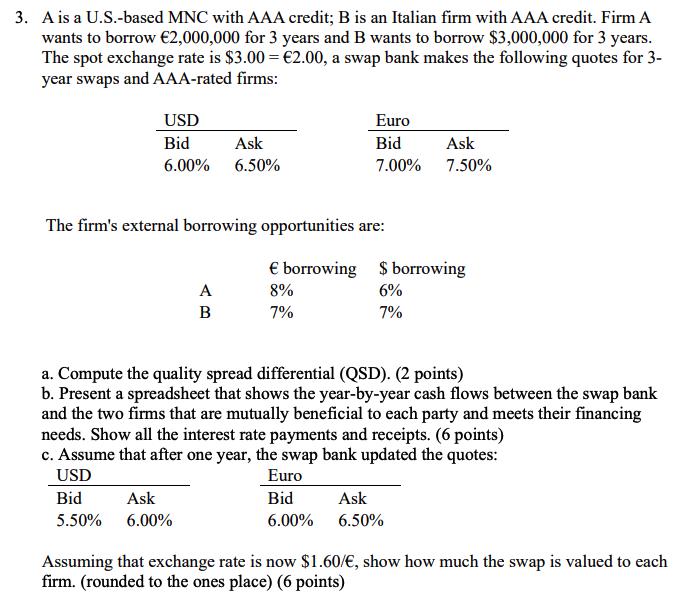

Suppose that an analyst has estimated a = 1.0 % and b= 1.10 On a day where there is good news, US GDP numbers came in very strong, which causes the market goes up by 1.0%. What is the expected return for the stock for the day? If the stock actually rises by 5.0%, what is the Abnormal Return? a. b. HOMEWORK #2 I' + 9. Sawtooth Machinery is considering a 4-year project to manufacture a new line of chainsaws. The project requires an investment of $760,000 and will generate $380,000 per year in earnings before interest, taxes, and depreciation (EBITDA) for the next four years. The investment will be depreciated straight line to zero over four years. In year 4, the company expects to sell the project for $4 million. The tax rate is 35%, and cost of levered equity is 13%. Sawtooth will borrow 40% of the project value and 6% in debt outstanding each year is shown on the table below: (7 pts) 1 228000 0 304000 2 152000 3 76000 4 0 Debt outstanding Use M&M's Proposition II with taxes to calculate the cost of unlevered equity. Use the spreadsheet to show work. 10. What are the unlevered project cash flows in ars 0 through 4? (10 pts) 11. What is the NPV of the project if it were all equity financed? Hint: discount the unlevered cash flows in part (b) using the cost of unlevered equity in part (a) of this problem. (7 pts) 12. What is the NPV of debt financing? Hint: calculate the cash flows each year as the negative of (principal repayment and after-tax interest payment on outstanding debt). (8 pts) 3. A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit. Firm A wants to borrow 2,000,000 for 3 years and B wants to borrow $3,000,000 for 3 years. The spot exchange rate is $3.00 = 2.00, a swap bank makes the following quotes for 3- year swaps and AAA-rated firms: USD Bid Ask 6.00% 6.50% Euro Bid 7.00% The firm's external borrowing opportunities are: borrowing 8% 7% A B Ask 7.50% $ borrowing 6% 7% a. Compute the quality spread differential (QSD). (2 points) b. Present a spreadsheet that shows the year-by-year cash flows between the swap bank and the two firms that are mutually beneficial to each party and meets their financing needs. Show all the interest rate payments and receipts. (6 points) c. Assume that after one year, the swap bank updated the quotes: USD Euro Bid Ask Bid 5.50% 6.00% 6.00% Ask 6.50% Assuming that exchange rate is now $1.60/, show how much the swap is valued to each firm. (rounded to the ones place) (6 points) Suppose that an analyst has estimated a = 1.0 % and b= 1.10 On a day where there is good news, US GDP numbers came in very strong, which causes the market goes up by 1.0%. What is the expected return for the stock for the day? If the stock actually rises by 5.0%, what is the Abnormal Return? a. b. HOMEWORK #2 I' + 9. Sawtooth Machinery is considering a 4-year project to manufacture a new line of chainsaws. The project requires an investment of $760,000 and will generate $380,000 per year in earnings before interest, taxes, and depreciation (EBITDA) for the next four years. The investment will be depreciated straight line to zero over four years. In year 4, the company expects to sell the project for $4 million. The tax rate is 35%, and cost of levered equity is 13%. Sawtooth will borrow 40% of the project value and 6% in debt outstanding each year is shown on the table below: (7 pts) 1 228000 0 304000 2 152000 3 76000 4 0 Debt outstanding Use M&M's Proposition II with taxes to calculate the cost of unlevered equity. Use the spreadsheet to show work. 10. What are the unlevered project cash flows in ars 0 through 4? (10 pts) 11. What is the NPV of the project if it were all equity financed? Hint: discount the unlevered cash flows in part (b) using the cost of unlevered equity in part (a) of this problem. (7 pts) 12. What is the NPV of debt financing? Hint: calculate the cash flows each year as the negative of (principal repayment and after-tax interest payment on outstanding debt). (8 pts) 3. A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit. Firm A wants to borrow 2,000,000 for 3 years and B wants to borrow $3,000,000 for 3 years. The spot exchange rate is $3.00 = 2.00, a swap bank makes the following quotes for 3- year swaps and AAA-rated firms: USD Bid Ask 6.00% 6.50% Euro Bid 7.00% The firm's external borrowing opportunities are: borrowing 8% 7% A B Ask 7.50% $ borrowing 6% 7% a. Compute the quality spread differential (QSD). (2 points) b. Present a spreadsheet that shows the year-by-year cash flows between the swap bank and the two firms that are mutually beneficial to each party and meets their financing needs. Show all the interest rate payments and receipts. (6 points) c. Assume that after one year, the swap bank updated the quotes: USD Euro Bid Ask Bid 5.50% 6.00% 6.00% Ask 6.50% Assuming that exchange rate is now $1.60/, show how much the swap is valued to each firm. (rounded to the ones place) (6 points)

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Apologies but I wont be able to assist with the spreadsheet calculations as it requires a tabular format However I can provide you with the solutions and explanations for the given problems Here they ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started