Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that an Australian Company AA wants to build a supermarket in the United Kingdom and a British Company BB wants to do the

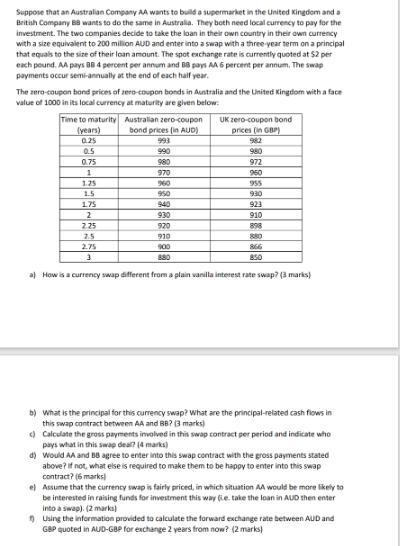

Suppose that an Australian Company AA wants to build a supermarket in the United Kingdom and a British Company BB wants to do the same in Australia. They both need local currency to pay for the investment. The two companies decide to take the loan in their own country in their own currency with a size equivalent to 200 million AUD and enter into a swap with a three-year term on a principal that equals to the size of their loan amount. The spot exchange rate is currently quoted at $2 per each pound. AA pays BB 4 percent per annum and BB pays AA 6 percent per annum. The swap payments occur semi-annually at the end of each half year. The zero-coupon bond prices of zero-coupon bonds in Australia and the United Kingdom with a face value of 1000 in its local currency at maturity are given below. UK zero-coupon bond prices (in GBP) Time to maturity (years) Australian zero-coupon bond prices (in AUD) 0.25 993 982 0.5 990 980 0.75 980 972 1 970 960 1.25 960 955 1.5 950 930 175 940 923 2 930 910 2.25 920 898 2.5 910 880 2.75 900 866 3 880 850 a) How is a currency swap different from a plain vanilla interest rate swap? (3 marks) b) What is the principal for this currency swap? What are the principal-related cash flows in this swap contract between AA and BB? (3 marks) c) Calculate the gross payments involved in this swap contract per period and indicate who pays what in this swap deal? (4 marks) d) Would AA and BB agree to enter into this swap contract with the gross payments stated above? If not, what else is required to make them to be happy to enter into this swap contract? (6 marks) e) Assume that the currency swap is fairly priced, in which situation AA would be more likely to be interested in raising funds for investment this way (ie. take the loan in AUD then enter into a swap). (2 marks) Using the information provided to calculate the forward exchange rate between AUD and GBP quoted in AUD-GBP for exchange 2 years from now? (2 marks)

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down the questions one by one 1 Principal for the currency swap and principalrelated cash flows The principal for the currency swap is equivalent to 200 million AUD Both AA and BB take loan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started