Answered step by step

Verified Expert Solution

Question

1 Approved Answer

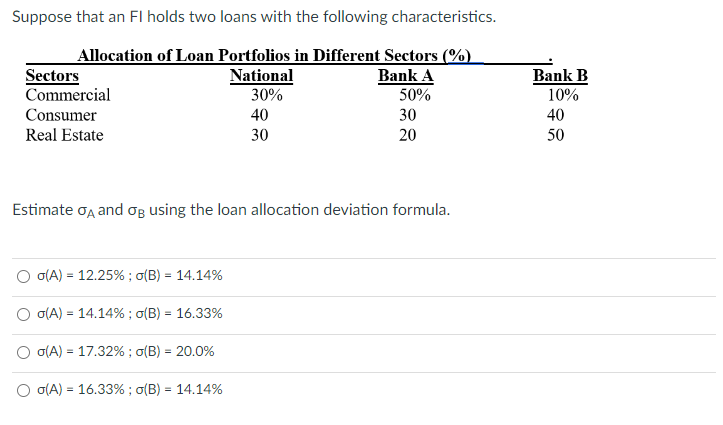

Suppose that an FI holds two loans with the following characteristics. Estimate A and B using the loan allocation deviation formula. (A)=12.25%;(B)=14.14%(A)=14.14%;(B)=16.33%(A)=17.32%;(B)=20.0%(A)=16.33%;(B)=14.14% Assume the same

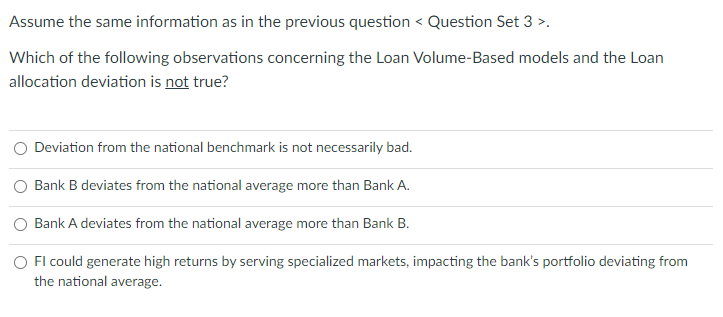

Suppose that an FI holds two loans with the following characteristics. Estimate A and B using the loan allocation deviation formula. (A)=12.25%;(B)=14.14%(A)=14.14%;(B)=16.33%(A)=17.32%;(B)=20.0%(A)=16.33%;(B)=14.14% Assume the same information as in the previous question Question Set 3. Which of the following observations concerning the Loan Volume-Based models and the Loan allocation deviation is not true? Deviation from the national benchmark is not necessarily bad. Bank B deviates from the national average more than Bank A. Bank A deviates from the national average more than Bank B. FI could generate high returns by serving specialized markets, impacting the bank's portfolio deviating from the national average

Suppose that an FI holds two loans with the following characteristics. Estimate A and B using the loan allocation deviation formula. (A)=12.25%;(B)=14.14%(A)=14.14%;(B)=16.33%(A)=17.32%;(B)=20.0%(A)=16.33%;(B)=14.14% Assume the same information as in the previous question Question Set 3. Which of the following observations concerning the Loan Volume-Based models and the Loan allocation deviation is not true? Deviation from the national benchmark is not necessarily bad. Bank B deviates from the national average more than Bank A. Bank A deviates from the national average more than Bank B. FI could generate high returns by serving specialized markets, impacting the bank's portfolio deviating from the national average Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started