Question

Suppose that an inventor estimates that by spending $200,000 he/she can invent a technology that would win the competition with probability 2%. However, the inventor

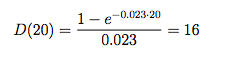

Suppose that an inventor estimates that by spending $200,000 he/she can invent a technology that would win the competition with probability 2%. However, the inventor also thinks that with that same investment and the same probability of success, he/she can get a patent that would allow him/her to become a monopolist (who does not price discriminate) for 20 years. After those 20 years, intense competition will drive profits to zero. The discount rate of this inventor is r = 0.023, so that

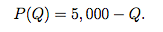

Suppose that the inventor also estimates that each year he/she will face an inverse market demand of

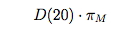

The marginal cost of selling the invention is 2, 000. Compute the net present value of becoming a monopolist for 20 years. That is, compute the value of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started