Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that Boeing Ghuna Corporation exported a Boeing 747 to British Airways and billed 10 million payable in one year. The money market interest rates

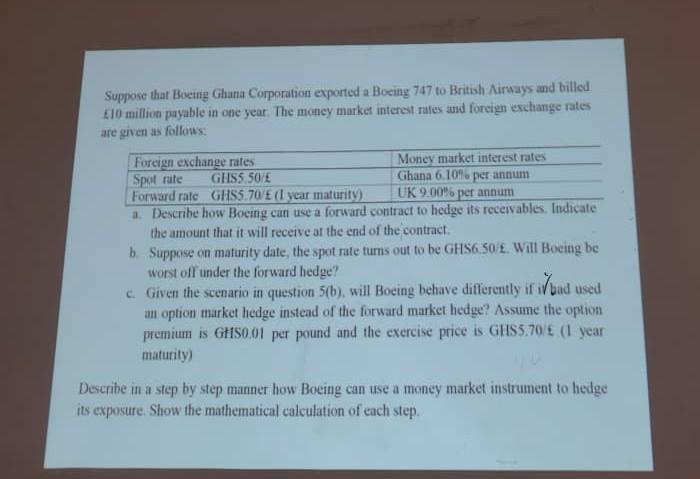

Suppose that Boeing Ghuna Corporation exported a Boeing 747 to British Airways and billed 10 million payable in one year. The money market interest rates and foreign exchange rates are given as follows: Foreign exchange rates Money market interest rates Spot rute GHS5.50/ Ghana 6,10% per annum Forward rate GHS5.70/E (I vear maturity) UK 9.00% per annum a. Describe how Boeing can use a forward contract to hedge its receivables. Indicate the amount that it will receive at the end of the contract b. Suppose on maturity date, the spot rate turns out to be GFS6.50/. Will Boeing be worst off under the forward hedge? c. Given the scenario in question 5(b) , will Boeing behave differently ir Mond used an option market hedge instead of the forward market hedge? Assume the option premium is GHS001 per pound and the exercise price is GHS5.70/ (1 year maturity) Describe in a step by step manner how Boeing can use a money market instrument to hedge its exposure. Show the mathematical calculation of each step

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started