Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that bond ABC is the underlying asset for a futures contract with settlement six months from now. You know the following about bond ABC

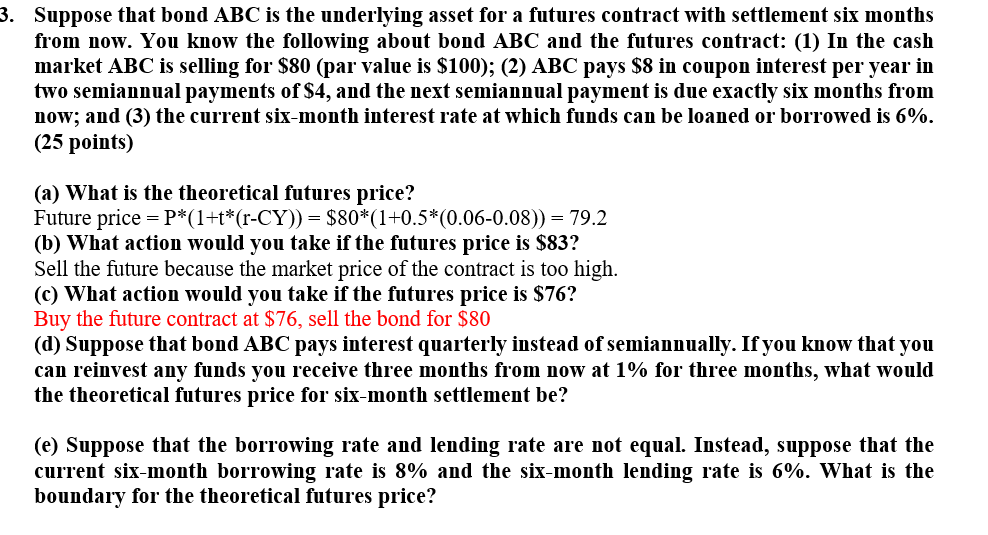

Suppose that bond ABC is the underlying asset for a futures contract with settlement six months from now. You know the following about bond ABC and the futures contract: (1) In the cash market ABC is selling for $80 (par value is $100 ); (2) ABC pays $8 in coupon interest per year in two semiannual payments of $4, and the next semiannual payment is due exactly six months from now; and (3) the current six-month interest rate at which funds can be loaned or borrowed is 6%. (25 points) (a) What is the theoretical futures price? Future price =P(1+t(rCY))=$80(1+0.5(0.060.08))=79.2 (b) What action would you take if the futures price is $83 ? Sell the future because the market price of the contract is too high. (c) What action would you take if the futures price is $76 ? Buy the future contract at $76, sell the bond for $80 (d) Suppose that bond ABC pays interest quarterly instead of semiannually. If you know that you can reinvest any funds you receive three months from now at 1% for three months, what would the theoretical futures price for six-month settlement be? (e) Suppose that the borrowing rate and lending rate are not equal. Instead, suppose that the current six-month borrowing rate is 8% and the six-month lending rate is 6%. What is the boundary for the theoretical futures price

Suppose that bond ABC is the underlying asset for a futures contract with settlement six months from now. You know the following about bond ABC and the futures contract: (1) In the cash market ABC is selling for $80 (par value is $100 ); (2) ABC pays $8 in coupon interest per year in two semiannual payments of $4, and the next semiannual payment is due exactly six months from now; and (3) the current six-month interest rate at which funds can be loaned or borrowed is 6%. (25 points) (a) What is the theoretical futures price? Future price =P(1+t(rCY))=$80(1+0.5(0.060.08))=79.2 (b) What action would you take if the futures price is $83 ? Sell the future because the market price of the contract is too high. (c) What action would you take if the futures price is $76 ? Buy the future contract at $76, sell the bond for $80 (d) Suppose that bond ABC pays interest quarterly instead of semiannually. If you know that you can reinvest any funds you receive three months from now at 1% for three months, what would the theoretical futures price for six-month settlement be? (e) Suppose that the borrowing rate and lending rate are not equal. Instead, suppose that the current six-month borrowing rate is 8% and the six-month lending rate is 6%. What is the boundary for the theoretical futures price Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started