Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- Suppose that company A is attempting to acquire company T via unsolicited tender offer. The offer is for a share exchange with exchange

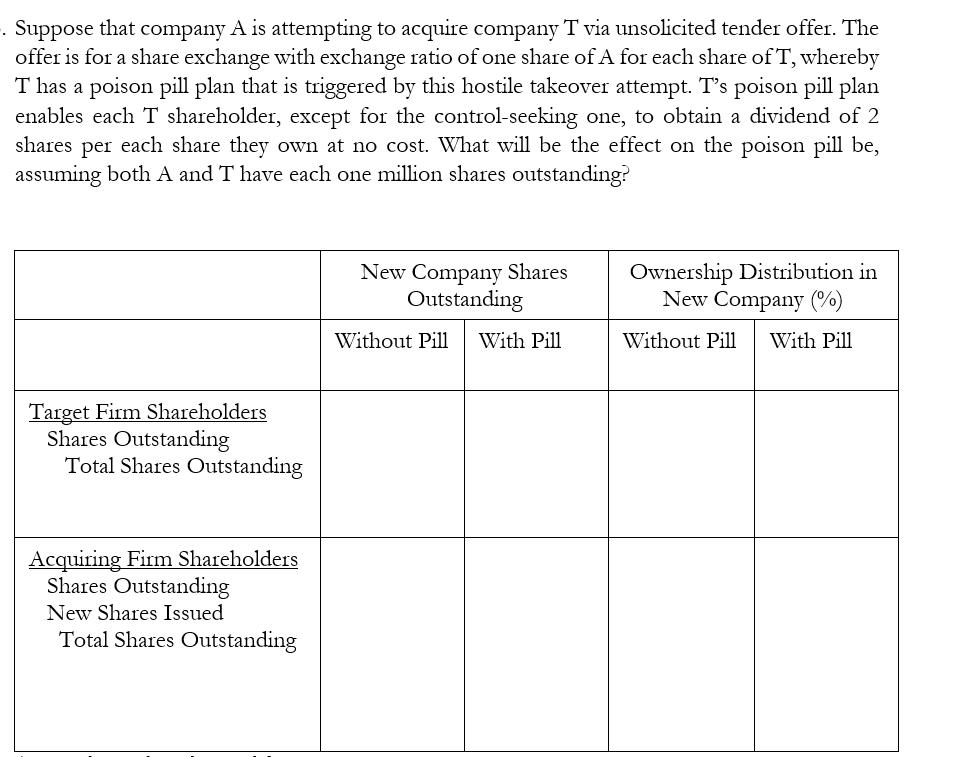

- Suppose that company A is attempting to acquire company T via unsolicited tender offer. The offer is for a share exchange with exchange ratio of one share of A for each share of T, whereby T has a poison pill plan that is triggered by this hostile takeover attempt. T's poison pill plan enables each T shareholder, except for the control-seeking one, to obtain a dividend of 2 shares per each share they own at no cost. What will be the effect on the poison pill be, assuming both A and T have each one million shares outstanding? Target Firm Shareholders Shares Outstanding Total Shares Outstanding Acquiring Firm Shareholders Shares Outstanding New Shares Issued Total Shares Outstanding New Company Shares Outstanding Without Pill With Pill Ownership Distribution in New Company (%) Without Pill With Pill

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

It appears there is an image containing text and a table that needs to be filled in The text describes a corporate finance scenario involving two comp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started