Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that continuously compounded zero rates with their corresponding maturities are given as follows: 3 . Consider again the zero rates and maturities in the

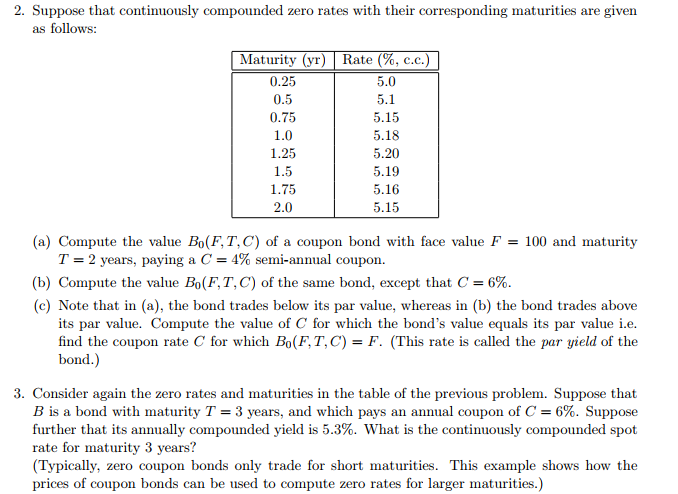

Suppose that continuously compounded zero rates with their corresponding maturities are given

as follows:

Consider again the zero rates and maturities in the table of the previous problem. Suppose that

is a bond with maturity years, and which pays an annual coupon of Suppose

further that its annually compounded yield is What is the continuously compounded spot

rate for maturity years?

Typically zero coupon bonds only trade for short maturities. This example shows how the

prices of coupon bonds can be used to compute zero rates for larger maturities.

NB: please only do question Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started