Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that Cott Corporation (COT) is considering adding a new product. Cott currently sells apple juice, and they are considering adding a new fruit

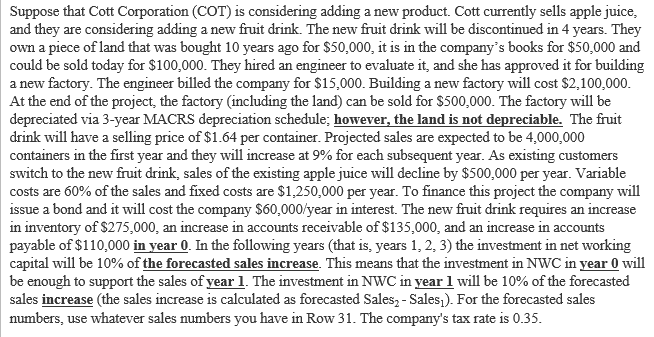

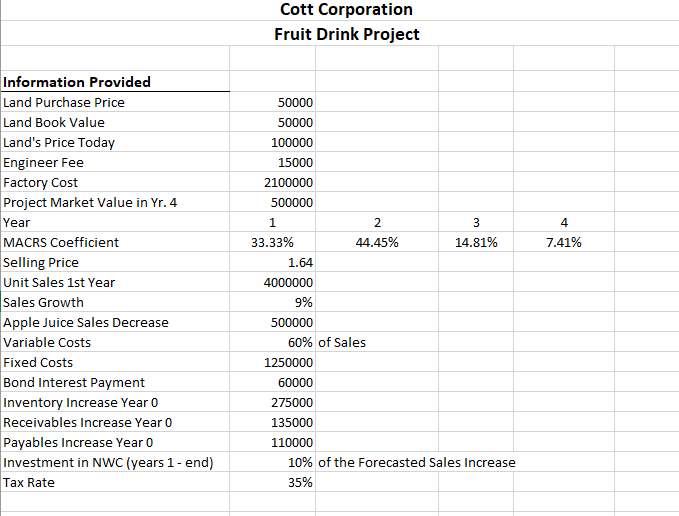

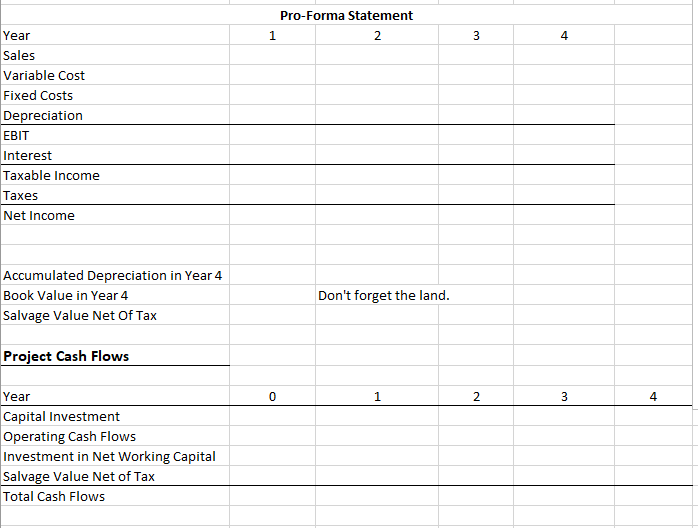

Suppose that Cott Corporation (COT) is considering adding a new product. Cott currently sells apple juice, and they are considering adding a new fruit drink. The new fruit drink will be discontinued in 4 years. They own a piece of land that was bought 10 years ago for $50,000, it is in the company's books for $50,000 and could be sold today for $100,000. They hired an engineer to evaluate it, and she has approved it for building a new factory. The engineer billed the company for $15,000. Building a new factory will cost $2,100,000. At the end of the project, the factory (including the land) can be sold for $500,000. The factory will be depreciated via 3-year MACRS depreciation schedule; however, the land is not depreciable. The fruit drink will have a selling price of $1.64 per container. Projected sales are expected to be 4,000,000 containers in the first year and they will increase at 9% for each subsequent year. As existing customers switch to the new fruit drink, sales of the existing apple juice will decline by $500,000 per year. Variable costs are 60% of the sales and fixed costs are $1,250,000 per year. To finance this project the company will issue a bond and it will cost the company $60,000/year in interest. The new fruit drink requires an increase in inventory of $275,000, an increase in accounts receivable of $135,000, and an increase in accounts payable of $110,000 in year 0. In the following years (that is, years 1, 2, 3) the investment in net working capital will be 10% of the forecasted sales increase. This means that the investment in NWC in year 0 will be enough to support the sales of year 1. The investment in NWC in year 1 will be 10% of the forecasted sales increase (the sales increase is calculated as forecasted Sales, - Sales). For the forecasted sales numbers, use whatever sales numbers you have in Row 31. The company's tax rate is 0.35.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to calculate the proforma statements and project cash flows Well do th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started