Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that Deblin Pension Fund purchased Critico stock at the market price of $120 per share, and to hedge against what they think will be

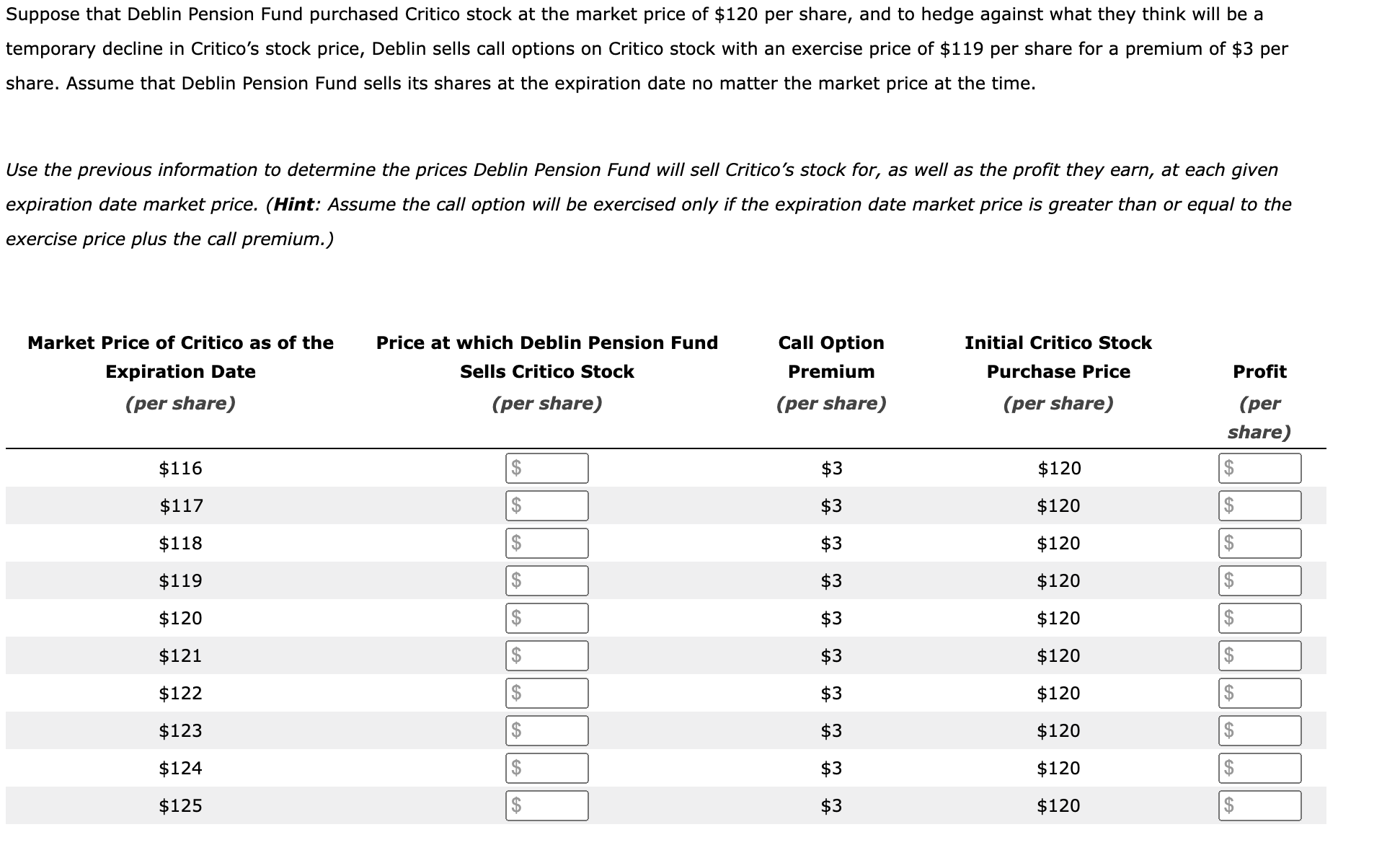

Suppose that Deblin Pension Fund purchased Critico stock at the market price of $120 per share, and to hedge against what they think will be a temporary decline in Critico's stock price, Deblin sells call options on Critico stock with an exercise price of $119 per share for a premium of $3 per share. Assume that Deblin Pension Fund sells its shares at the expiration date no matter the market price at the time. Use the previous information to determine the prices Deblin Pension Fund will sell Critico's stock for, as well as the profit they earn, at each given expiration date market price. (Hint: Assume the call option will be exercised only if the expiration date market price is greater than or the

Suppose that Deblin Pension Fund purchased Critico stock at the market price of $120 per share, and to hedge against what they think will be a temporary decline in Critico's stock price, Deblin sells call options on Critico stock with an exercise price of $119 per share for a premium of $3 per share. Assume that Deblin Pension Fund sells its shares at the expiration date no matter the market price at the time. Use the previous information to determine the prices Deblin Pension Fund will sell Critico's stock for, as well as the profit they earn, at each given expiration date market price. (Hint: Assume the call option will be exercised only if the expiration date market price is greater than or the Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started