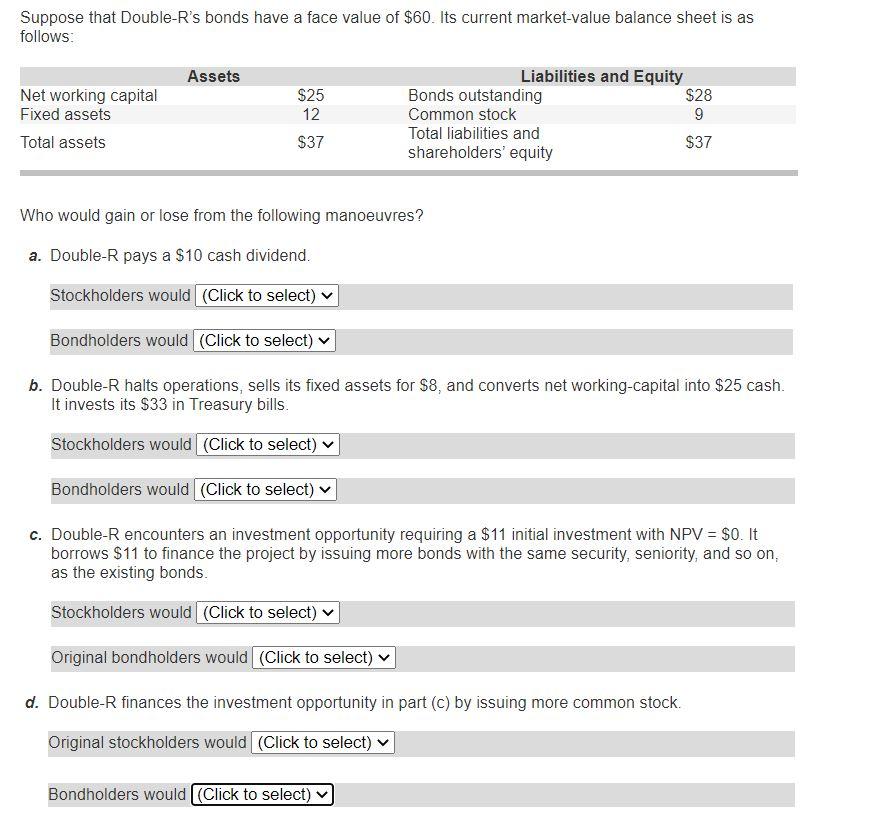

Suppose that Double-R's bonds have a face value of $60. Its current market value balance sheet is as follows: Assets Net working capital Fixed assets Total assets $25 12 $37 Liabilities and Equity Bonds outstanding $28 Common stock 9 Total liabilities and $37 shareholders' equity Who would gain or lose from the following manoeuvres? a. Double-R pays a $10 cash dividend. Stockholders would (Click to select) Bondholders would (Click to select) b. Double-R halts operations, sells its fixed assets for $8, and converts net working-capital into $25 cash. It invests its $33 in Treasury bills. Stockholders would (Click to select) Bondholders would (Click to select) c. Double-Rencounters an investment opportunity requiring a $11 initial investment with NPV = $O. It borrows $11 to finance the project by issuing more bonds with the same security, seniority, and so on, as the existing bonds. Stockholders would (Click to select) v Original bondholders would (Click to select) d. Double-R finances the investment opportunity in part (C) by issuing more common stock. Original stockholders would (Click to select) Bondholders would (Click to select) Suppose that Double-R's bonds have a face value of $60. Its current market value balance sheet is as follows: Assets Net working capital Fixed assets Total assets $25 12 $37 Liabilities and Equity Bonds outstanding $28 Common stock 9 Total liabilities and $37 shareholders' equity Who would gain or lose from the following manoeuvres? a. Double-R pays a $10 cash dividend. Stockholders would (Click to select) Bondholders would (Click to select) b. Double-R halts operations, sells its fixed assets for $8, and converts net working-capital into $25 cash. It invests its $33 in Treasury bills. Stockholders would (Click to select) Bondholders would (Click to select) c. Double-Rencounters an investment opportunity requiring a $11 initial investment with NPV = $O. It borrows $11 to finance the project by issuing more bonds with the same security, seniority, and so on, as the existing bonds. Stockholders would (Click to select) v Original bondholders would (Click to select) d. Double-R finances the investment opportunity in part (C) by issuing more common stock. Original stockholders would (Click to select) Bondholders would (Click to select)