Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that General Motor (GM) and Tesla Inc. (TSLA) were trading at $10.70 and $20.69 at t=0, respectively. Further, you invested $10,000 in an

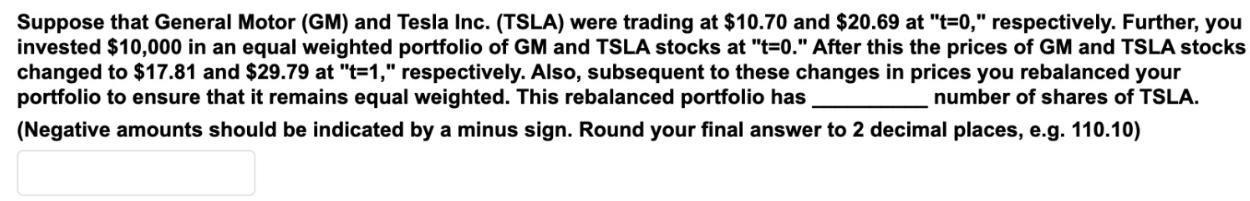

Suppose that General Motor (GM) and Tesla Inc. (TSLA) were trading at $10.70 and $20.69 at "t=0," respectively. Further, you invested $10,000 in an equal weighted portfolio of GM and TSLA stocks at "t=0." After this the prices of GM and TSLA stocks changed to $17.81 and $29.79 at "t=1," respectively. Also, subsequent to these changes in prices you rebalanced your portfolio to ensure that it remains equal weighted. This rebalanced portfolio has number of shares of TSLA. (Negative amounts should be indicated by a minus sign. Round your final answer to 2 decimal places, e.g. 110.10)

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the number of shares of TSLA in the rebalanced portfolio we need to determine the value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started