Question

Suppose that in a country, there are only two banks, Bank A and Bank B. The fileBank Balance Sheets shows their balance sheets. Here are

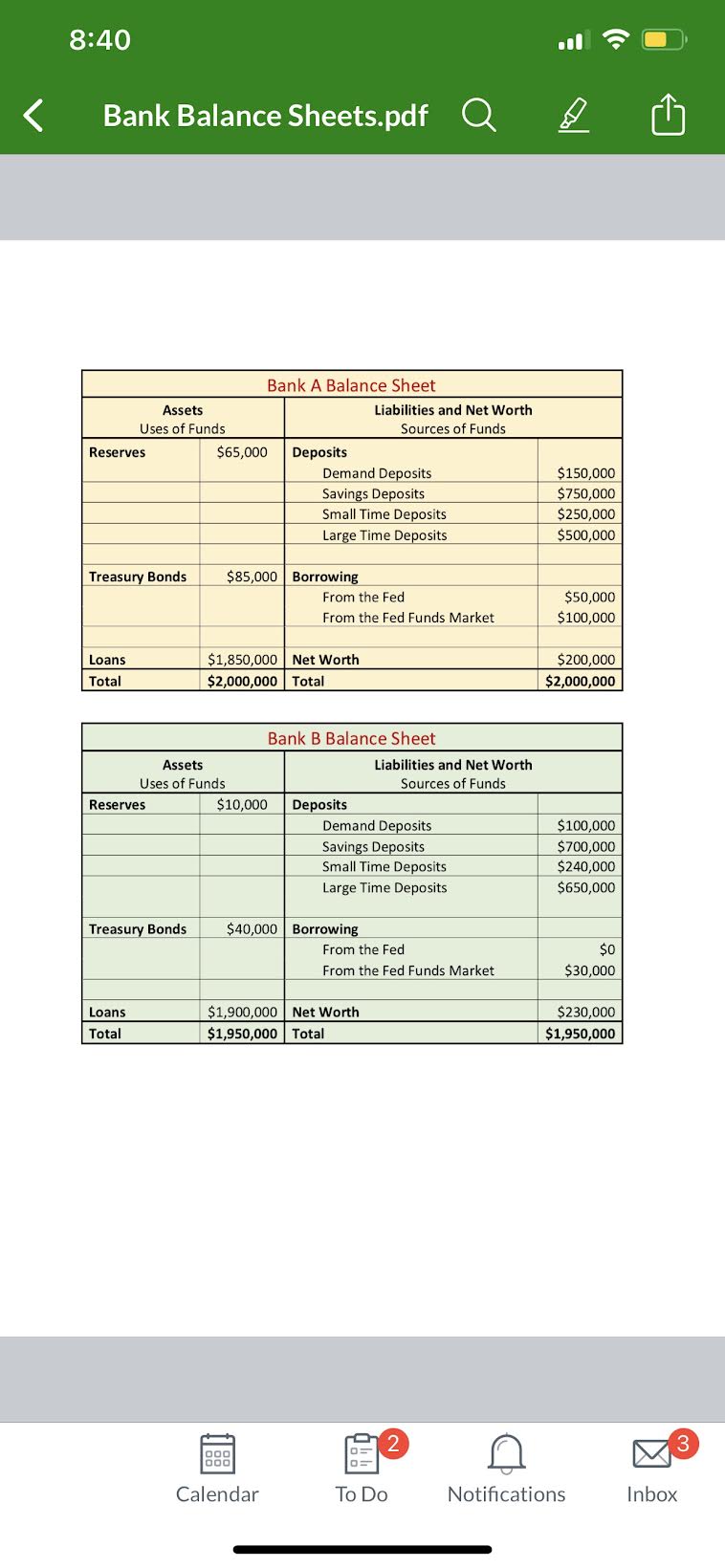

Suppose that in a country, there are only two banks, Bank A and Bank B. The fileBank Balance Sheets shows their balance sheets. Here are some simplifying assumptions to make our lives a bit more bearable: 1 The country uses dollars as its unit of accounts. 2 There are no travelers' checks in this country. 3 The amount of retail money market money mutual funds shares equals $100,000. 4 The amount of currency held by the non-bank public is $25,000. This amount will remain the same throughout our story. 5 All the reserves are held at the central bank. They also call their central bank "the Fed". 6 There are no reserve requirements (the required reserve ratio is zero). 7 Note that the dollar amounts reported for different deposit accounts are the sums of funds many depositors hold in those accounts. For example, the sum of all the small time deposits (less than $100,000) owned by all the depositors in Bank A is $250,000. 8 We will call this the base case. Using the Fed's rule post May 2020: M1 money supply equals dollars and the M2 money supply equals dollars. Using the Fed's rule prior to May 2020: M1 money supply equals dollars and the M2 money supply equals dollars.

< 8:40 Bank Balance Sheets.pdf Q Reserves Assets Uses of Funds Treasury Bonds Loans Total Reserves Loans Total Treasury Bonds $65,000 Assets Uses of Funds Bank A Balance Sheet $85,000 Borrowing $10,000 Deposits $1,850,000 Net Worth $2,000,000 Total Demand Deposits Savings Deposits Small Time Deposits Large Time Deposits 000 000 Calendar From the Fed From the Fed Funds Market Liabilities and Net Worth Sources of Funds Bank B Balance Sheet Deposits $40,000 Borrowing Demand Deposits Savings Deposits Small Time Deposits Large Time Deposits $1,900,000 Net Worth $1,950,000 Total Liabilities and Net Worth Sources of Funds From the Fed From the Fed Funds Market 2 D= 0= To Do 8 (C $150,000 $750,000 $250,000 $500,000 $50,000 $100,000 $200,000 $2,000,000 $100,000 $700,000 $240,000 $650,000 $0 $30,000 $230,000 $1,950,000 Notifications 3 Inbox

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided balance sheets for Bank A and Bank B we can analyze the components of their as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started