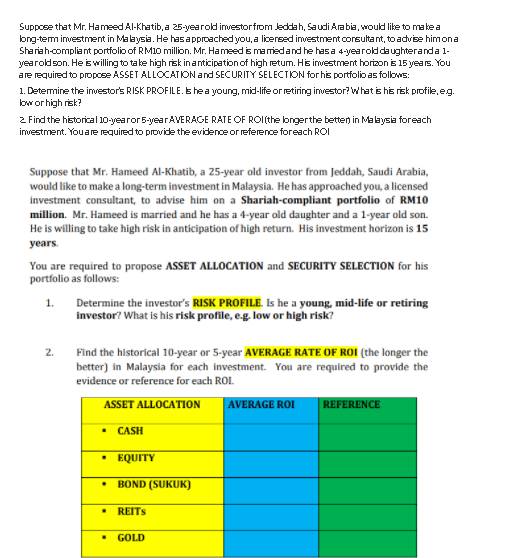

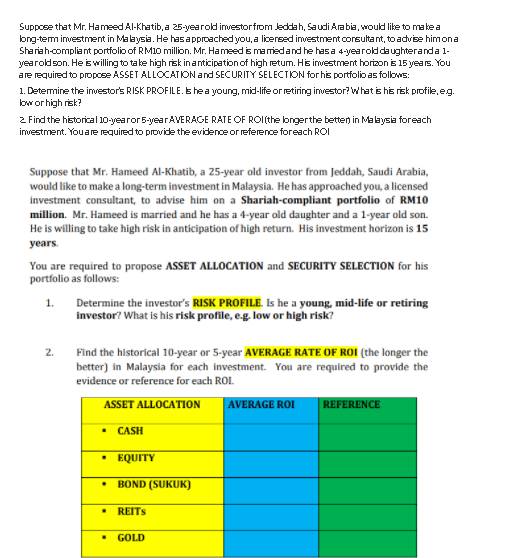

Suppose that Mr. Hameed Al-Khatib, a 25-yearold investorfrom Jeddah, Saudi Arabia, would like to make a long-tem investment in Malaysia. He has approached you, a licensed investment consultant, to advise himona Shariah-compliant portfolio of RM10 million. Mr. Hameed is mariedand he has a 4-yearold daughteranda 1- yearoldson. He is willing to take high rek in anticipation of high retum. His investment horizon is 15 years. You are required to propose ASSET ALLOCATION and SECURITY SELECTION for his portfolio as follows: 1. Determine the investor's RISK PROFILE. E hea young, mid-life or retiring investor? What is his risk profile, eg. low or high risk? 2 Find the historical 10-yearor 5-year AVERAGE RATE OF ROI(the longerthe betten in Malaysia foreach investment. Youare required to provide the evidence or reference foreach ROI Suppose that Mr. Hameed Al-Khatib, a 25-year old investor from Jeddah, Saudi Arabia, would like to make a long-term investment in Malaysia. He has approached you, a licensed investment consultant, to advise him on a Shariah-compliant portfolio of RM10 million. Mr. Hameed is married and he has a 4-year old daughter and a 1-year old son. He is willing to take high risk in anticipation of high return. His investment horizon is 15 years You are required to propose ASSET ALLOCATION and SECURITY SELECTION for his portfolio as follows: 1. Determine the investor's RISK PROFILE. Is he a young, mid-life or retiring investor? What is his risk profile, e.g. low or high risk? 2. Find the historical 10-year or 5-year AVERAGE RATE OF ROI (the longer the better) in Malaysia for each investment. You are required to provide the evidence or reference for each ROI. ASSET ALLOCATION AVERAGE ROI REFERENCE CASH EQUITY BOND (SUKUK) . REITS GOLD Suppose that Mr. Hameed Al-Khatib, a 25-yearold investorfrom Jeddah, Saudi Arabia, would like to make a long-tem investment in Malaysia. He has approached you, a licensed investment consultant, to advise himona Shariah-compliant portfolio of RM10 million. Mr. Hameed is mariedand he has a 4-yearold daughteranda 1- yearoldson. He is willing to take high rek in anticipation of high retum. His investment horizon is 15 years. You are required to propose ASSET ALLOCATION and SECURITY SELECTION for his portfolio as follows: 1. Determine the investor's RISK PROFILE. E hea young, mid-life or retiring investor? What is his risk profile, eg. low or high risk? 2 Find the historical 10-yearor 5-year AVERAGE RATE OF ROI(the longerthe betten in Malaysia foreach investment. Youare required to provide the evidence or reference foreach ROI Suppose that Mr. Hameed Al-Khatib, a 25-year old investor from Jeddah, Saudi Arabia, would like to make a long-term investment in Malaysia. He has approached you, a licensed investment consultant, to advise him on a Shariah-compliant portfolio of RM10 million. Mr. Hameed is married and he has a 4-year old daughter and a 1-year old son. He is willing to take high risk in anticipation of high return. His investment horizon is 15 years You are required to propose ASSET ALLOCATION and SECURITY SELECTION for his portfolio as follows: 1. Determine the investor's RISK PROFILE. Is he a young, mid-life or retiring investor? What is his risk profile, e.g. low or high risk? 2. Find the historical 10-year or 5-year AVERAGE RATE OF ROI (the longer the better) in Malaysia for each investment. You are required to provide the evidence or reference for each ROI. ASSET ALLOCATION AVERAGE ROI REFERENCE CASH EQUITY BOND (SUKUK) . REITS GOLD