Question

Suppose that observations on a stock price (in dollars) at the end of each of 10 consecutive weeks are as follows: 30, 33, 31,

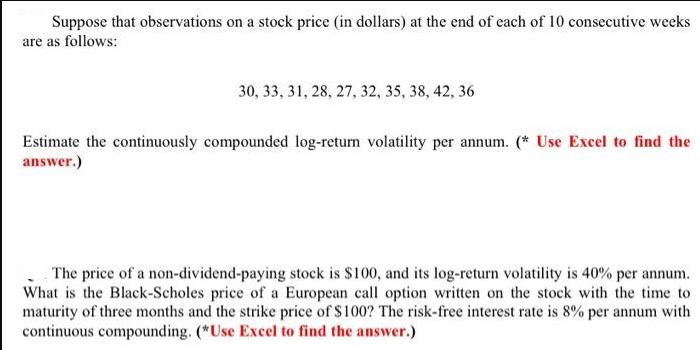

Suppose that observations on a stock price (in dollars) at the end of each of 10 consecutive weeks are as follows: 30, 33, 31, 28, 27, 32, 35, 38, 42, 36 Estimate the continuously compounded log-return volatility per annum. (* Use Excel to find the answer.) The price of a non-dividend-paying stock is $100, and its log-return volatility is 40% per annum. What is the Black-Scholes price of a European call option written on the stock with the time to maturity of three months and the strike price of $100? The risk-free interest rate is 8% per annum with continuous compounding. (*Use Excel to find the answer.)

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to solve this problem in Excel 1 To estimate the continuously ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Research In Psychology Methods And Design

Authors: C James Goodwin

8th Edition

1119330440, 978-1119330448

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App