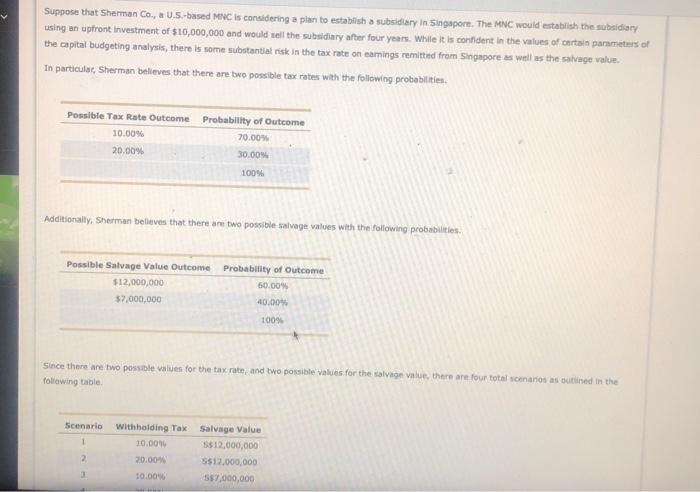

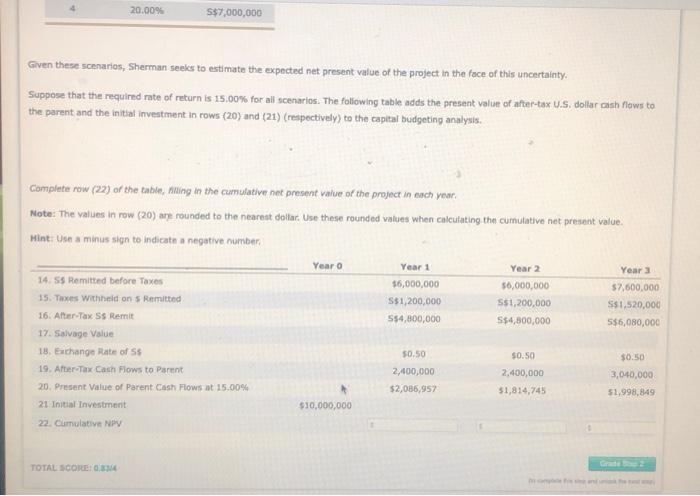

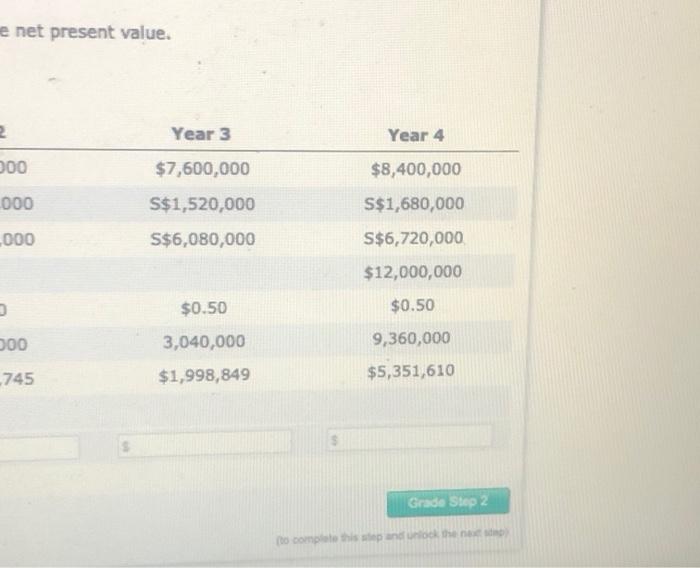

Suppose that Sherman Co., U.S.-based MNC is considering a plan to establish a subsidiary in Singapore. The MNC would establish the subsidiary using an upfront Investment of $10,000,000 and would sell the subsidiary after four years. While it is confident in the values of certain parameters of the capital budgeting analysis, there is some substantiat risk in the tax rate on eamings remitted from Singapore as well as the salvage value. In particular, Sherman believes that there are two possible tax rates with the following probabilities Possible Tax Rate Outcome Probability of Outcome 10.00% 70.00% 20.00% 30.00% 1009 Additionally, Sherman believes that there are two possible salvage values with the following probabilities Possible Salvage Value Outcome Probability of Outcome $12,000,000 50.00% $7,000,000 40.00% 100% Since there are two possible values for the tax rate, and two possible values for the salvage value, there are four total scenarios as outlined in the following table Scenario withholding Tax 10.00 20.00% 10.00 Salvage Value $$12,000,000 5512,000,000 5$7,000,000 20.00% S$7,000,000 Given these scenarios, Sherman seeks to estimate the expected net present value of the project in the face of this uncertainty. Suppose that the required rate of return is 15,00% for all scenarios. The following table adds the present value of after-tax U.S. dollar cash flows to the parent and the initial investment in rows (20) and (21) (respectively) to the capital budgeting analysis. Complete row (22) or the table, miling in the cumulative net present value of the project in each year, Note: The values in row (20) are rounded to the nearest dollar. Use these rounded values when calculating the cumulative net present value. Hint: Use se a minus sign to indicate a negative number Year o Yeart Year 2 Year 14. SS Remitted before Taxes $6,000,000 56,000,000 $7,600,000 15. Taxes Withheld on 5 Remitted S$1,200,000 S$1,200,000 S$1.520,000 16. After Tax SS Remit 554,800,000 S$4,800,000 5$6,080,000 17. Salvage Value 18. Exchange Rate of SS 50.50 $0.50 $0.50 19. After Tax Cash Flows to Parent 2,400,000 2.400,000 3,040,000 20. Present Value of Parent Cash Flows at 15.00% $2,086,957 51,814,745 51.998,849 21 Initial Investment $10,000,000 22. Cumulative NP TOTAL SCORE e net present value. 2 Year 3 Year 4 300 $8,400,000 000 $7,600,000 S$1,520,000 S$6,080,000 S$1,680,000 .000 S$6,720,000 $12,000,000 $0.50 $0.50 000 3,040,000 9,360,000 $5,351,610 -745 $1,998,849 Grade Step 2 to complete this step and then