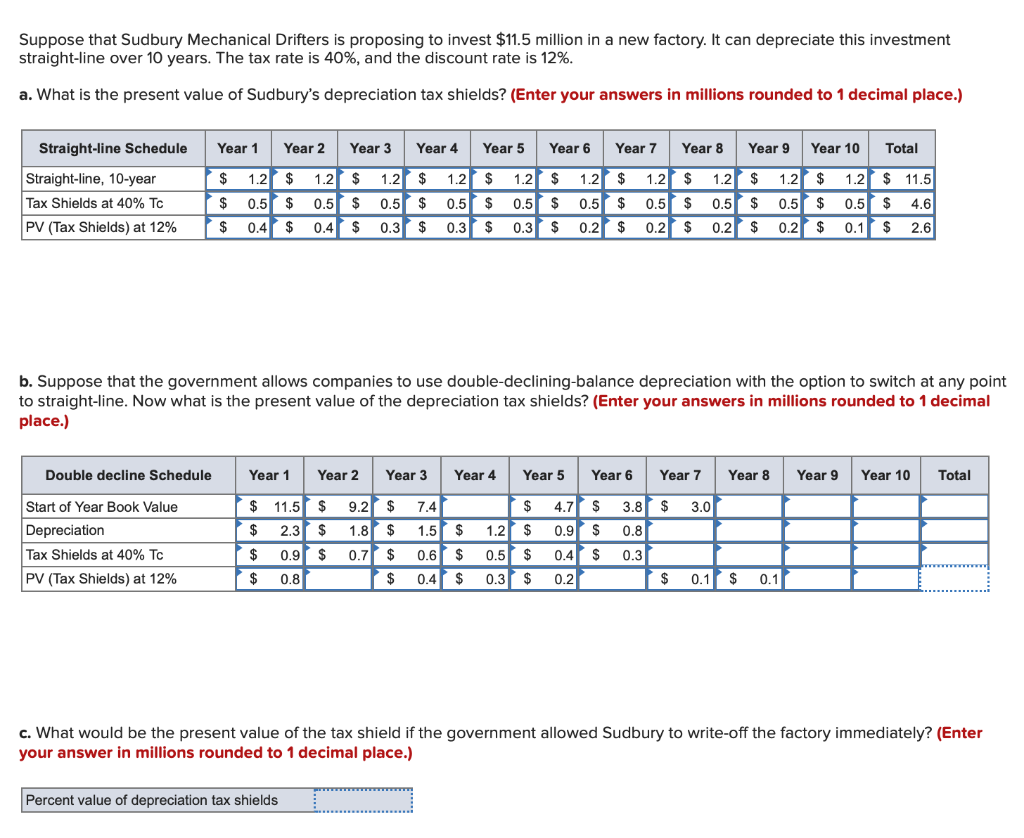

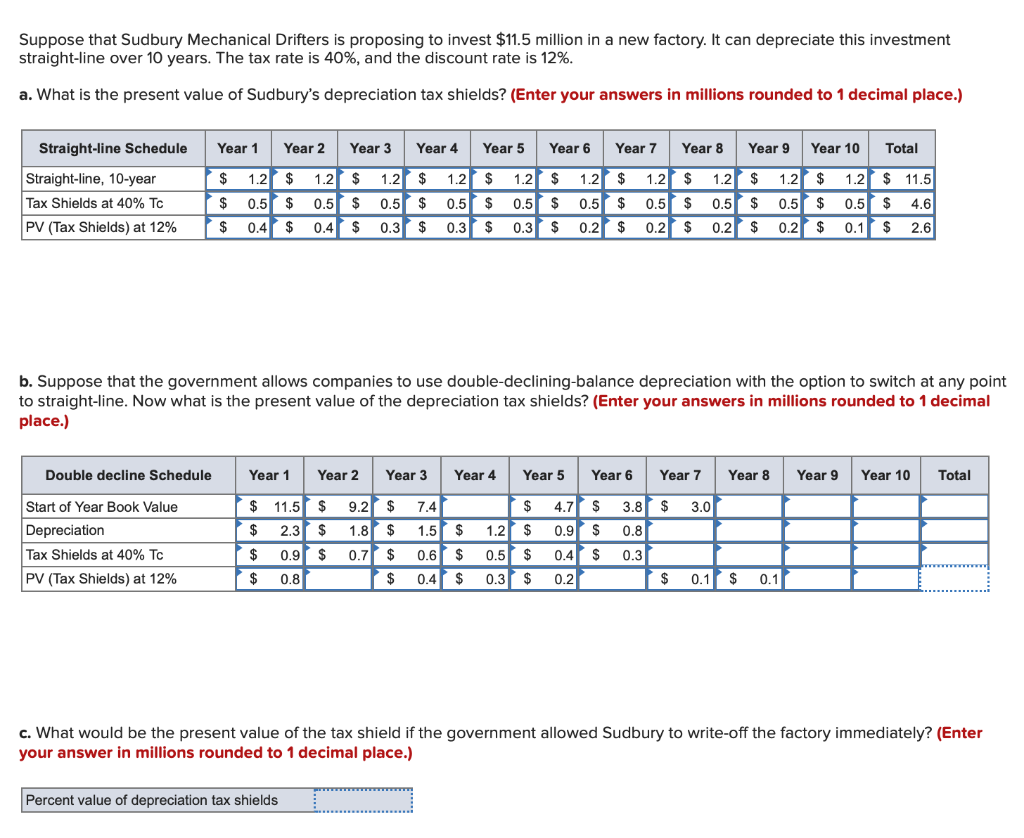

Suppose that Sudbury Mechanical Drifters is proposing to invest $11.5 million in a new factory. It can depreciate this investment straight-line over 10 years. The tax rate is 40%, and the discount rate is 12%. a. What is the present value of Sudbury's depreciation tax shields? (Enter your answers in millions rounded to 1 decimal place.) Straight-line Schedule Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Total Straight-line, 10-year Tax Shields at 40% Tc PV (Tax Shields) at 12% $ 1.2 $ $ 0.5 $ $ 0.4 $ 1.2 $ 1.2 $ 1.2 $ 0.51 $ 0.5 $ 0.5 $ 0.4 $ 0.3 $ 0.3 $ 1.2 $ 0.5 $ 0.3 $ 1.2 $ 0.5 $ 0.2 $ 1.2 $ 1.2 $ 1.2 $ 1.21 $ 11.5 0.5 $ 0.5 $ 0.5 $ 0.5 $ 4.6 0.2 $ 0.2 $ 0.2 $ 0.1 $ 2.6 b. Suppose that the government allows companies to use double-declining-balance depreciation with the option to switch at any point to straight-line. Now what is the present value of the depreciation tax shields? (Enter your answers in millions rounded to 1 decimal place.) Double decline Schedule Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Total 3.0 3.8 $ 0.8 Start of Year Book Value Depreciation Tax Shields at 40% Tc PV (Tax Shields) at 12% $ 11.5 $ $ 2.31 $ $ 0.9 $ $ 0.8 9.2 $ 7.4 $ 1.8 $ 1.5 $ 1.2 $ 0.7 $ 0.6 $ 0.5 $ $ 0.4 $ 0.3 $ 4.7 $ 0.9 $ 0.4 $ 0.2 0.3 $ 0.1 $ 0.1 c. What would be the present value of the tax shield if the government allowed Sudbury to write-off the factory immediately? (Enter your answer in millions rounded to 1 decimal place.) Percent value of depreciation tax shields Suppose that Sudbury Mechanical Drifters is proposing to invest $11.5 million in a new factory. It can depreciate this investment straight-line over 10 years. The tax rate is 40%, and the discount rate is 12%. a. What is the present value of Sudbury's depreciation tax shields? (Enter your answers in millions rounded to 1 decimal place.) Straight-line Schedule Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Total Straight-line, 10-year Tax Shields at 40% Tc PV (Tax Shields) at 12% $ 1.2 $ $ 0.5 $ $ 0.4 $ 1.2 $ 1.2 $ 1.2 $ 0.51 $ 0.5 $ 0.5 $ 0.4 $ 0.3 $ 0.3 $ 1.2 $ 0.5 $ 0.3 $ 1.2 $ 0.5 $ 0.2 $ 1.2 $ 1.2 $ 1.2 $ 1.21 $ 11.5 0.5 $ 0.5 $ 0.5 $ 0.5 $ 4.6 0.2 $ 0.2 $ 0.2 $ 0.1 $ 2.6 b. Suppose that the government allows companies to use double-declining-balance depreciation with the option to switch at any point to straight-line. Now what is the present value of the depreciation tax shields? (Enter your answers in millions rounded to 1 decimal place.) Double decline Schedule Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Total 3.0 3.8 $ 0.8 Start of Year Book Value Depreciation Tax Shields at 40% Tc PV (Tax Shields) at 12% $ 11.5 $ $ 2.31 $ $ 0.9 $ $ 0.8 9.2 $ 7.4 $ 1.8 $ 1.5 $ 1.2 $ 0.7 $ 0.6 $ 0.5 $ $ 0.4 $ 0.3 $ 4.7 $ 0.9 $ 0.4 $ 0.2 0.3 $ 0.1 $ 0.1 c. What would be the present value of the tax shield if the government allowed Sudbury to write-off the factory immediately? (Enter your answer in millions rounded to 1 decimal place.) Percent value of depreciation tax shields