Question

Suppose that Syntex Company have a project option with initial outlay requirement of $200 000 and possible free cash flows(operating cash flows) of $80 000,$105,000

Suppose that Syntex Company have a project option with initial outlay requirement of $200 000 and possible free cash flows(operating cash flows) of $80 000,$105,000 and $97,000 correspondingly. The firm has 1000 5 year annual coupon bonds outstanding (par value $1000) that have a coupon rate of 8% and YTM of 6%. Moreover, there are 500,000 shares outstanding with a Beta of 1.3 and market price of $37.Expected return on the market and the risk free rate is 10% and 3% accordingly. Assuming 20% tax rate,find solution to the following:

a)Calculate Project NPV

b)Determine whether the project should be accepted or not assuming that flotation costs amount to $25000.

c)Now suppose that the risk level of previously mentioned project is significantly different from that of company's average projects.

Information of proxy company is provided below a)consider the given information,b)find project NPV based on new information Cartex Company has an equity beta of 0.68 and is financed 20% by debt and 80% by equity.

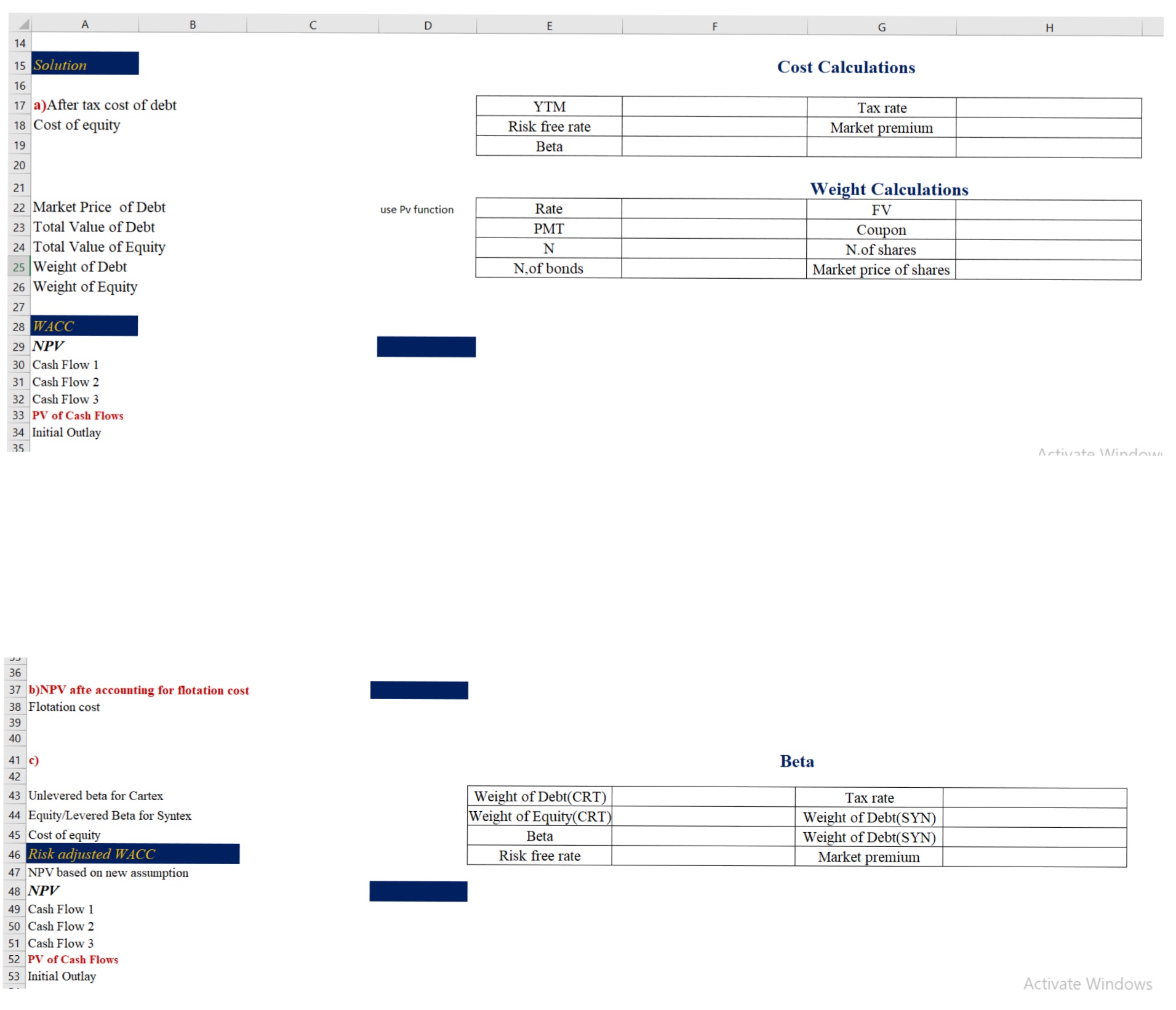

14 A B 15 Solution 16 17 a)After tax cost of debt 18 Cost of equity 19 20 D E F YTM Risk free rate Beta 21 22 Market Price of Debt use Pv function Rate PMT N N. of bonds 23 Total Value of Debt 24 Total Value of Equity 25 Weight of Debt 26 Weight of Equity 27 28 WACC 29 NPV 30 Cash Flow 1 31 Cash Flow 2 32 Cash Flow 3 33 PV of Cash Flows 34 Initial Outlay 35 36 37 b)NPV afte accounting for flotation cost 38 Flotation cost 39 40 41 c) 42 43 Unlevered beta for Cartex 44 Equity/Levered Beta for Syntex 45 Cost of equity 46 Risk adjusted WACC 47 NPV based on new assumption 48 NPV 49 Cash Flow 1 50 Cash Flow 2 51 Cash Flow 3 52 PV of Cash Flows 53 Initial Outlay G Cost Calculations Tax rate Market premium Weight Calculations FV Coupon N. of shares Market price of shares Weight of Debt(CRT) Weight of Equity(CRT) Beta Risk free rate Beta Tax rate Weight of Debt(SYN) Weight of Debt(SYN) Market premium Activate Window Activate Windows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started