1 . Suppose that TechnoTCL is considering a new project. They are trying to determine the required rate of return for their debt and equity

Suppose that TechnoTCL is considering a new project. They are trying to determine the required rate of return for their debt and equity holders. See the information below:

A percent annual coupon bond with years to maturity, selling for of par. The bonds make

annual payments. What is the before tax cost of debt? If the tax rate is what is the aftertax cost of

debt?

The firm's beta is The riskfree rate is and the expected market return is What is the cost of

equity using CAPM?

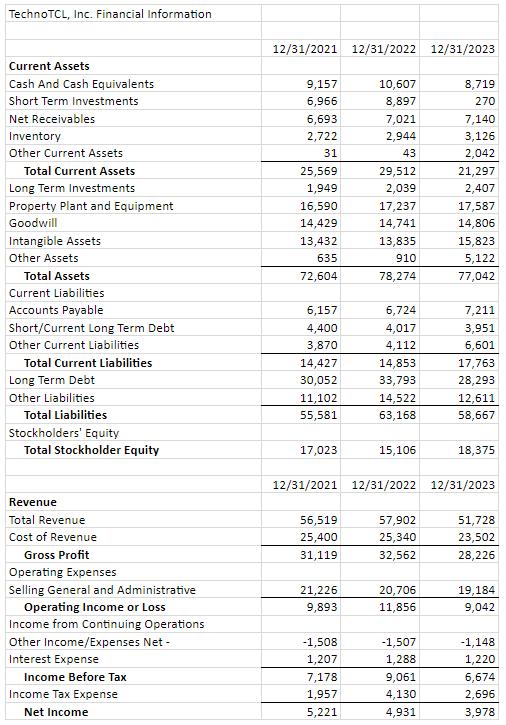

Use the balance sheet for TechnoTCL to determine the weighting for capital used by the company. What

are the weightings for longterm debt and common equity? Calculate the WACC for TechnoTCL.

If the company has three possible projects with the following characteristics and has $ available to

fund capital investments, what decision should be made for each project AC Why?

Possible Company Projects

Project Expected Return:

Project A

Project B

Project C

Capital Required:

Project A $

Project B $

Project C $

Please show your work.

TechnoTCL, Inc. Financial Information. 12/31/2021 12/31/2022 12/31/2023 Current Assets Cash And Cash Equivalents Short Term Investments Net Receivables Inventory 9,157 10,607 8,719 6,966 8,897 270 6,693 7,021 7,140 2,722 2,944 3,126 Other Current Assets 31 43 2,042 Total Current Assets 25,569 29,512 21,297 Long Term Investments 1,949 2,039 2,407 Property Plant and Equipment 16,590 17,237 17,587 Goodwill 14,429 14,741 14,806 Intangible Assets 13,432 13,835 15,823 Other Assets 635 910 5,122 Total Assets 72,604 78,274 77,042 Current Liabilities Accounts Payable 6,157 6,724 7,211 Short/Current Long Term Debt 4,400 4,017 3,951 Other Current Liabilities 3,870 4,112 6,601 Total Current Liabilities 14,427 14,853 17,763 Long Term Debt 30,052 33,793 28,293 Other Liabilities Total Liabilities Stockholders' Equity Total Stockholder Equity 12/31/2021 12/31/2022 12/31/2023 11,102 14,522 12,611 55,581 63,168 58,667 17,023 15,106 18,375 Revenue Total Revenue Cost of Revenue 56,519 57,902 51,728 25,400 25,340 23,502 Gross Profit 31,119 32,562 28,226 Operating Expenses Selling General and Administrative 21,226 20,706 19,184 Operating Income or Loss 9,893 11,856 9,042 Income from Continuing Operations Other Income/Expenses Net - -1,508 -1,507 -1,148 Interest Expense 1,207 1,288 1,220 Income Before Tax 7,178 9,061 6,674 Income Tax Expense Net Income 1,957 4,130 2,696 5,221 4,931 3,978

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the problem stepbystep and calculate each part 1 BeforeTax and AfterTax Cost of Debt The companys bonds have Coupon rate 65 Years to maturity 15 years Selling price 96 of par value Tax ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started