Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that the classical model of loanable funds displays the following characteristics. GDP (Y) is 5,000 while consumption (C) is given by the equation

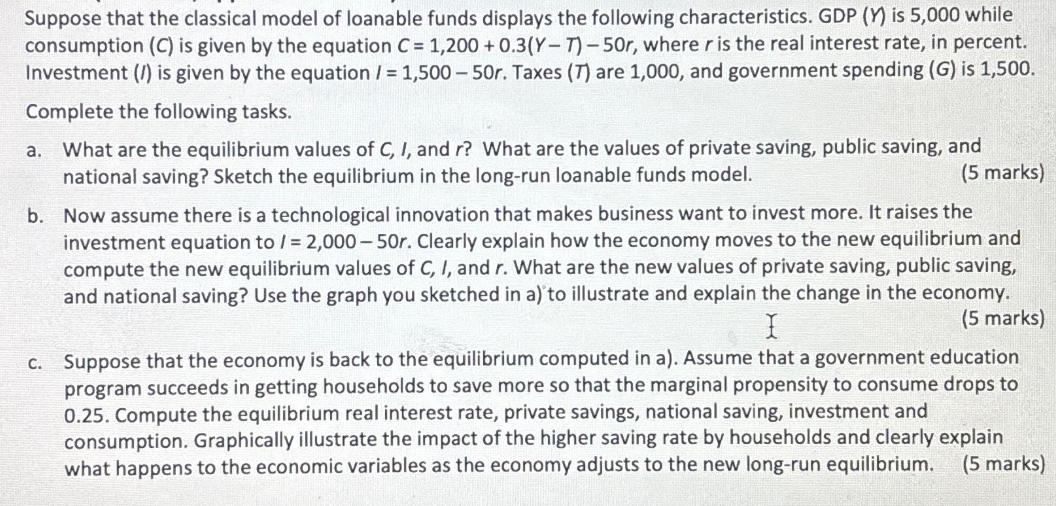

Suppose that the classical model of loanable funds displays the following characteristics. GDP (Y) is 5,000 while consumption (C) is given by the equation C = 1,200 +0.3(Y-T)-50r, where r is the real interest rate, in percent. Investment (/) is given by the equation / = 1,500-50r. Taxes (7) are 1,000, and government spending (G) is 1,500. Complete the following tasks. a. What are the equilibrium values of C, I, and r? What are the values of private saving, public saving, and national saving? Sketch the equilibrium in the long-run loanable funds model. (5 marks) b. Now assume there is a technological innovation that makes business want to invest more. It raises the investment equation to / = 2,000-50r. Clearly explain how the economy moves to the new equilibrium and compute the new equilibrium values of C, I, and r. What are the new values of private saving, public saving, and national saving? Use the graph you sketched in a) to illustrate and explain the change in the economy. I (5 marks) c. Suppose that the economy is back to the equilibrium computed in a). Assume that a government education program succeeds in getting households to save more so that the marginal propensity to consume drops to 0.25. Compute the equilibrium real interest rate, private savings, national saving, investment and consumption. Graphically illustrate the impact of the higher saving rate by households and clearly explain what happens to the economic variables as the economy adjusts to the new long-run equilibrium. (5 marks)

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Equilibrium values C 1200 035000 1000 50r 2000 15r I 1500 50r C I S T 2000 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started