Answered step by step

Verified Expert Solution

Question

1 Approved Answer

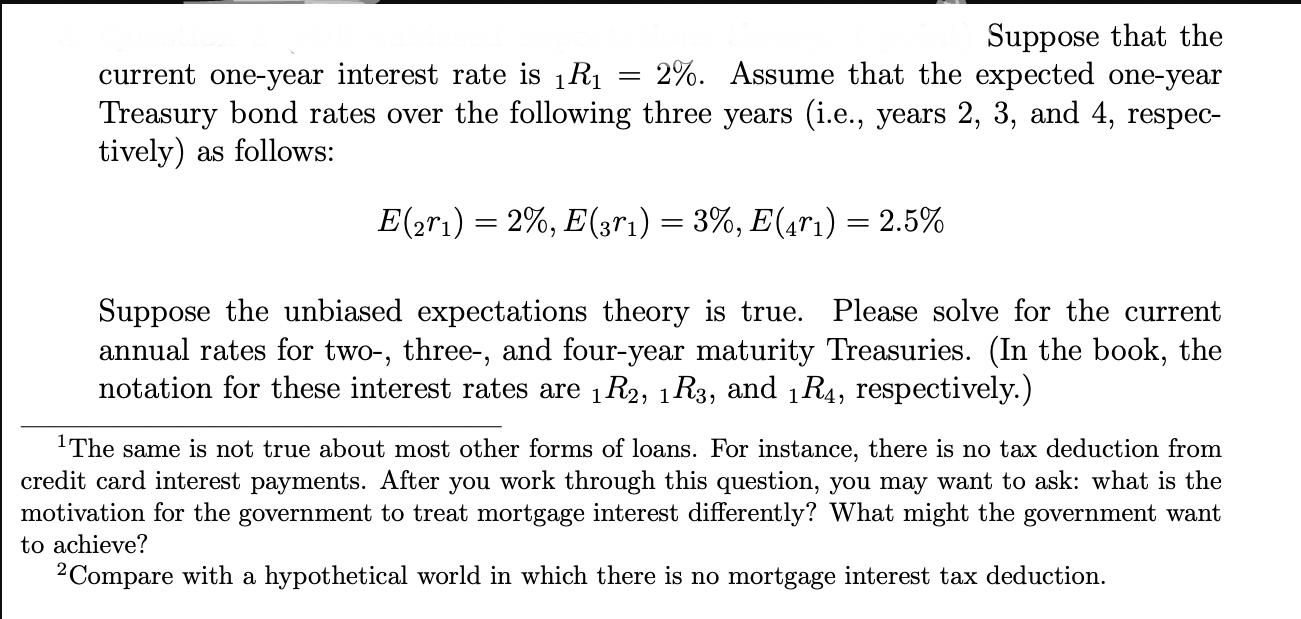

= Suppose that the current one-year interest rate is 1R 2%. Assume that the expected one-year Treasury bond rates over the following three years

= Suppose that the current one-year interest rate is 1R 2%. Assume that the expected one-year Treasury bond rates over the following three years (i.e., years 2, 3, and 4, respec- tively) as follows: E(21) = 2%, E(31) = 3%, E(41) = 2.5% Suppose the unbiased expectations theory is true. Please solve for the current annual rates for two-, three-, and four-year maturity Treasuries. (In the book, the notation for these interest rates are 1R2, 1R3, and 1R4, respectively.) 1The same is not true about most other forms of loans. For instance, there is no tax deduction from credit card interest payments. After you work through this question, you may want to ask: what is the motivation for the government to treat mortgage interest differently? What might the government want to achieve? 2 Compare with a hypothetical world in which there is no mortgage interest tax deduction.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solving for Treasury Rates using Unbiased Expectations Theory The unbiased expectations theory state...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started