Answered step by step

Verified Expert Solution

Question

1 Approved Answer

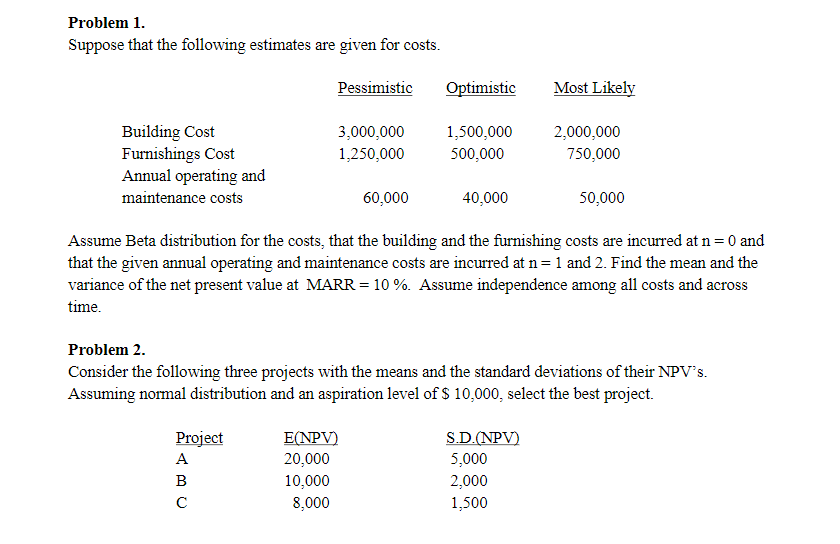

Suppose that the following estimates are given for costs. Pessimistic Optimistic Most Likely Building Cost 3,000,000 1,500,000 2,000,000 Furnishings Cost 1,250,000 500,000 750,000 Annual operating

Suppose that the following estimates are given for costs.

Pessimistic

Optimistic

Most Likely

Building Cost

3,000,000

1,500,000

2,000,000

Furnishings Cost

1,250,000

500,000

750,000

Annual operating and

maintenance costs

60,000

40,000

50,000

Assume Beta distribution for the costs, that the building and the furnishing costs are incurred at n = 0 and

that the given annual operating and maintenance costs are incurred at n =

1 and 2. Find the mean and the

variance of the net present value at MARR = 10 %. Assume independence among all costs and across

time.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started