Question

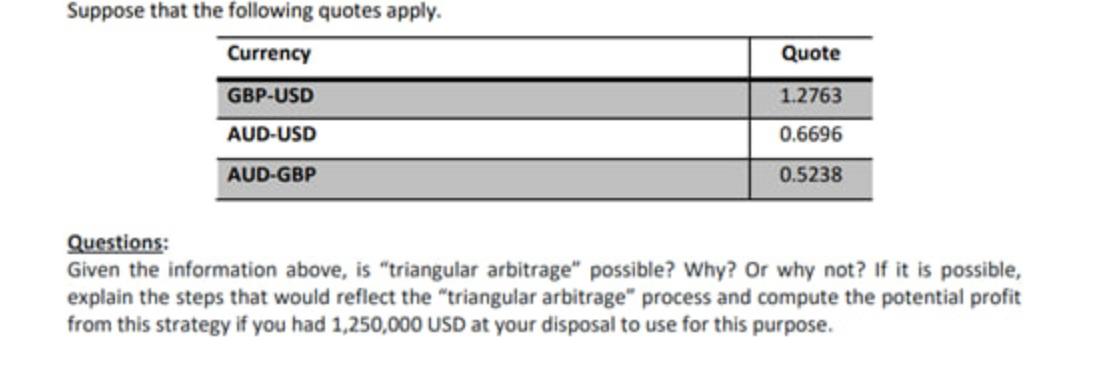

Suppose that the following quotes apply. Currency GBP-USD AUD-USD AUD-GBP Quote 1.2763 0.6696 0.5238 Questions: Given the information above, is triangular arbitrage possible? Why?

Suppose that the following quotes apply. Currency GBP-USD AUD-USD AUD-GBP Quote 1.2763 0.6696 0.5238 Questions: Given the information above, is "triangular arbitrage" possible? Why? Or why not? If it is possible, explain the steps that would reflect the "triangular arbitrage" process and compute the potential profit from this strategy if you had 1,250,000 USD at your disposal to use for this purpose.

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Triangular arbitrage is an event that can occur in the foreign exchange markets when the exchange rates do not perfectly match up These discrepancies ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Accounting Information for Decision-Making and Strategy Execution

Authors: Anthony A. Atkinson, Robert S. Kaplan, Ella Mae Matsumura, S. Mark Young

6th Edition

137024975, 978-0137024971

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App