Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that the management of Home Depot is considering the effects of various inventory costing methods on its financial statements and its income tax expense.

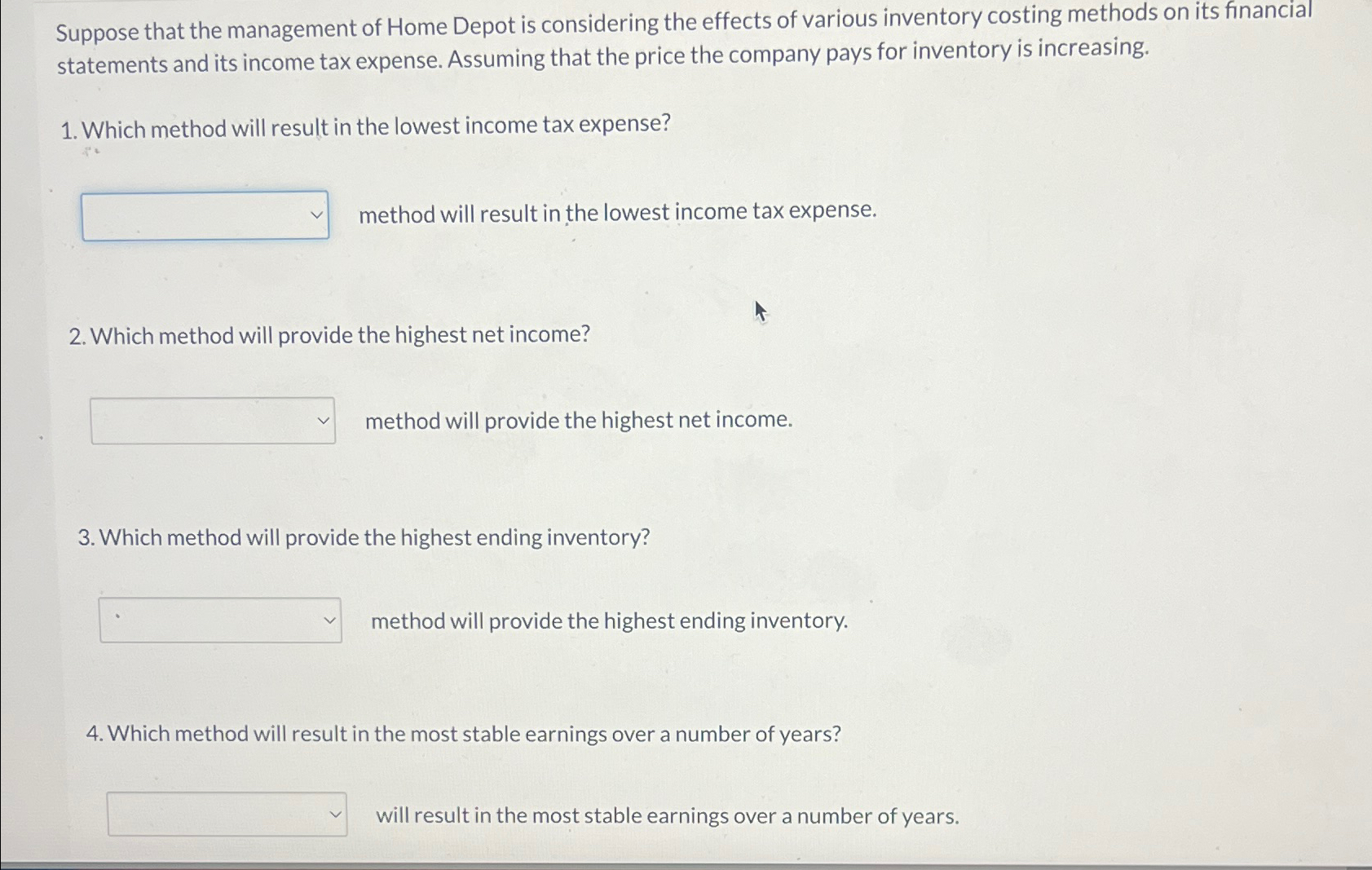

Suppose that the management of Home Depot is considering the effects of various inventory costing methods on its financial statements and its income tax expense. Assuming that the price the company pays for inventory is increasing.

Which method will result in the lowest income tax expense?

method will result in the lowest income tax expense.

Which method will provide the highest net income?

method will provide the highest net income.

Which method will provide the highest ending inventory?

method will provide the highest ending inventory.

Which method will result in the most stable earnings over a number of years?

will result in the most stable earnings over a number of years.

Options are : average cost method, FIFO, LIFO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started