Answered step by step

Verified Expert Solution

Question

1 Approved Answer

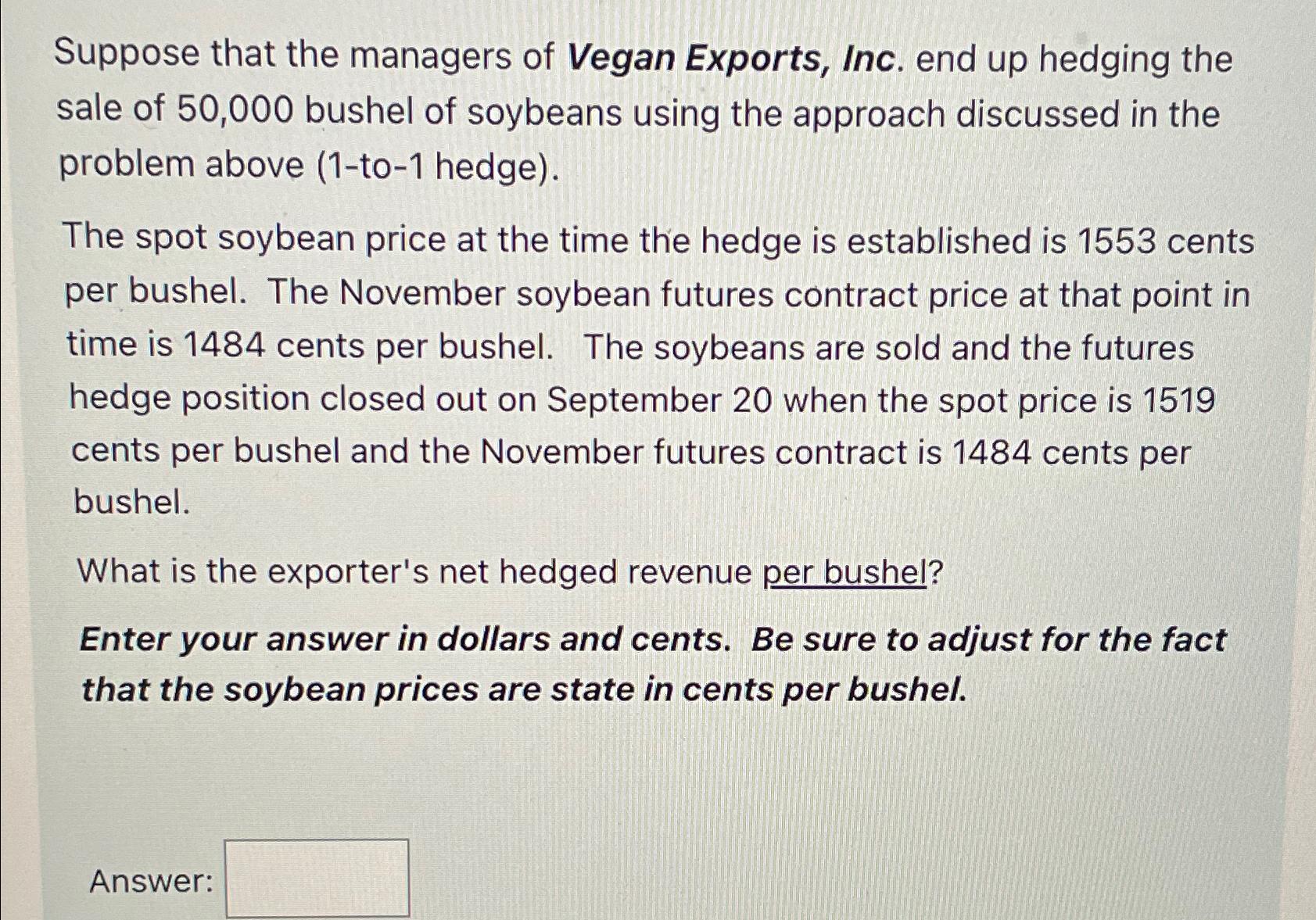

Suppose that the managers of Vegan Exports, Inc. end up hedging the sale of 5 0 , 0 0 0 bushel of soybeans using the

Suppose that the managers of Vegan Exports, Inc. end up hedging the sale of bushel of soybeans using the approach discussed in the problem above to hedge

The spot soybean price at the time the hedge is established is cents per bushel. The November soybean futures contract price at that point in time is cents per bushel. The soybeans are sold and the futures hedge position closed out on September when the spot price is cents per bushel and the November futures contract is cents per bushel.

What is the exporter's net hedged revenue per bushel?

Enter your answer in dollars and cents. Be sure to adjust for the fact that the soybean prices are state in cents per bushel.

Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started