Question: Suppose that the market expected return is 10% with standard deviation of 20%. As- sume further the risk-free rate is 5%. You are considering

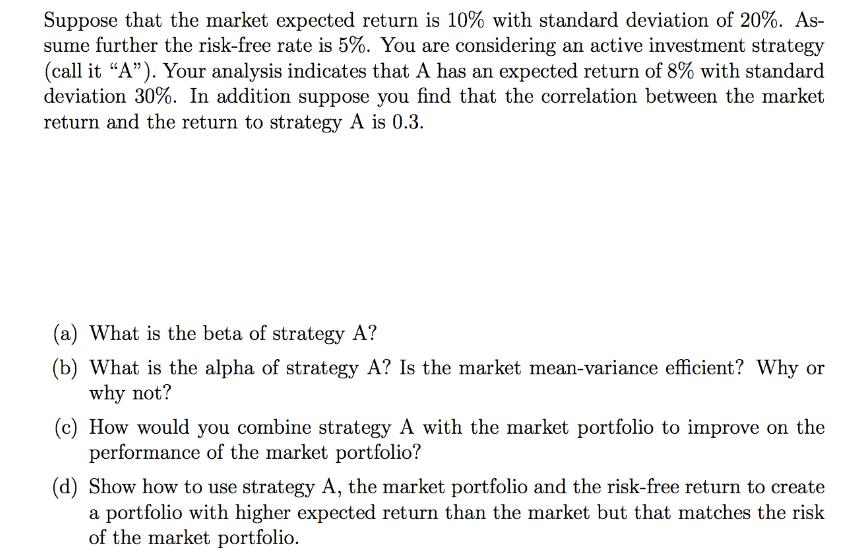

Suppose that the market expected return is 10% with standard deviation of 20%. As- sume further the risk-free rate is 5%. You are considering an active investment strategy (call it "A"). Your analysis indicates that A has an expected return of 8% with standard deviation 30%. In addition suppose you find that the correlation between the market return and the return to strategy A is 0.3. (a) What is the beta of strategy A? What is the alpha of strategy A? Is the market mean-variance efficient? Why or why not? (c) How would you combine strategy A with the market portfolio to improve on the performance of the market portfolio? (d) Show how to use strategy A, the market portfolio and the risk-free return to create a portfolio with higher expected return than the market but that matches the risk of the market portfolio.

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

SOLUTION a The beta of strategy A is given by A CovA M VarM where CovA M is the covariance between the returns of strategy A and the market portfolio and VarM is the variance of the market portfolio T... View full answer

Get step-by-step solutions from verified subject matter experts