Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that the only assets available for you to invest in are a risk-free bond yielding 3% per year and the S&P 500 ETF

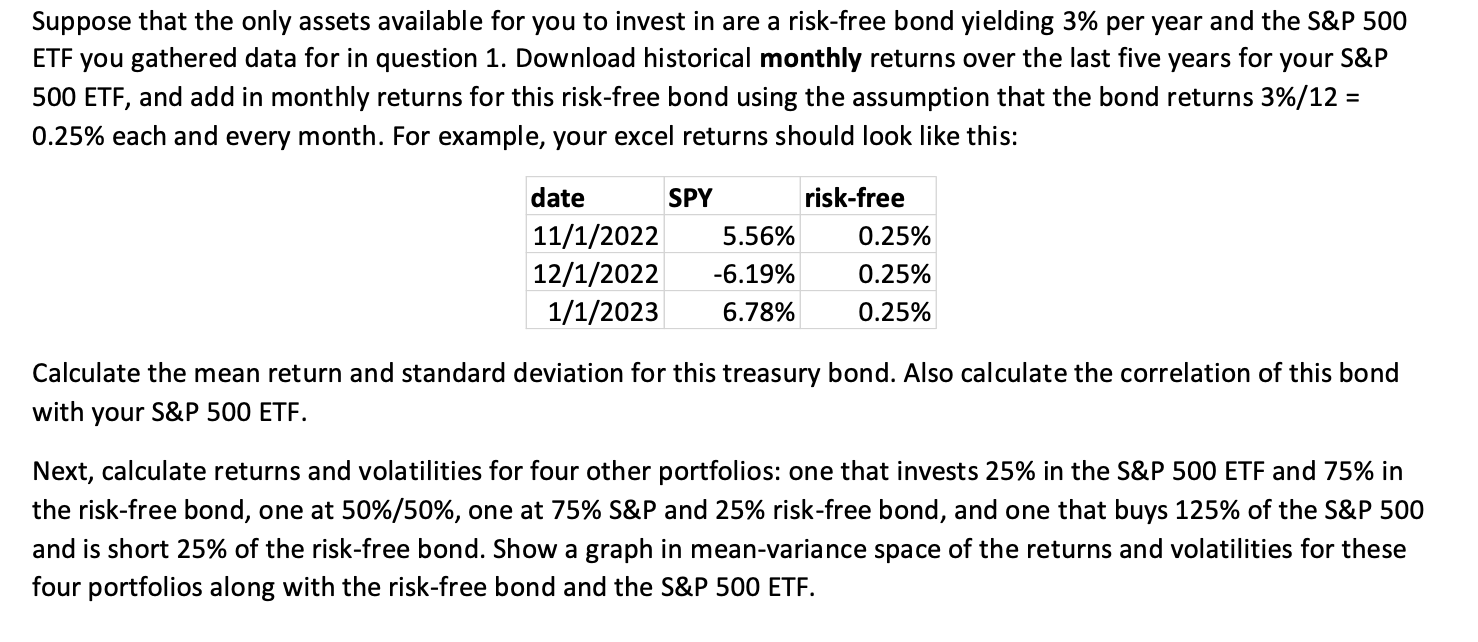

Suppose that the only assets available for you to invest in are a risk-free bond yielding 3% per year and the S&P 500 ETF you gathered data for in question 1. Download historical monthly returns over the last five years for your S&P 500 ETF, and add in monthly returns for this risk-free bond using the assumption that the bond returns 3%/12 = 0.25% each and every month. For example, your excel returns should look like this: date SPY risk-free 11/1/2022 5.56% 0.25% 12/1/2022 -6.19% 0.25% 1/1/2023 6.78% 0.25% Calculate the mean return and standard deviation for this treasury bond. Also calculate the correlation of this bond with your S&P 500 ETF. Next, calculate returns and volatilities for four other portfolios: one that invests 25% in the S&P 500 ETF and 75% in the risk-free bond, one at 50%/50%, one at 75% S&P and 25% risk-free bond, and one that buys 125% of the S&P 500 and is short 25% of the risk-free bond. Show a graph in mean-variance space of the returns and volatilities for these four portfolios along with the risk-free bond and the S&P 500 ETF.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the mean return and standard deviation for the riskfree bond we can use the monthly returns provided Since the bond returns 025 ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started