Answered step by step

Verified Expert Solution

Question

1 Approved Answer

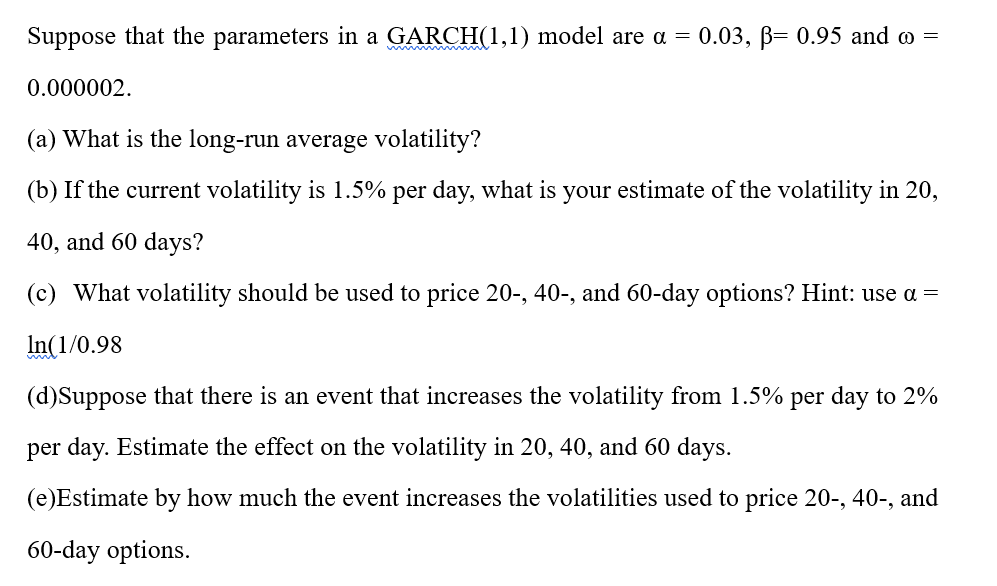

Suppose that the parameters in a GARCH ( 1 , 1 ) model are = 0 . 0 3 , = 0 . 9 5

Suppose that the parameters in a GARCH model are and

a What is the longrun average volatility?

b If the current volatility is per day, what is your estimate of the volatility in

and days?

c What volatility should be used to price and day options? Hint: use

dSuppose that there is an event that increases the volatility from per day to

per day. Estimate the effect on the volatility in and days.

eEstimate by how much the event increases the volatilities used to price and

day options.Suppose that the parameters in a GARCH model are alpha beta and omega

a What is the longrun average volatility?

b If the current volatility is per day, what is your estimate of the volatility in and days?

c What volatility should be used to price and day options? Hint: use alpha ln

dSuppose that there is an event that increases the volatility from per day to per day. Estimate the effect on the volatility in and days.

eEstimate by how much the event increases the volatilities used to price and day options.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started