Question

Suppose that the price of stock X today is S-$140. You are offered a European option on one share of stock X with a

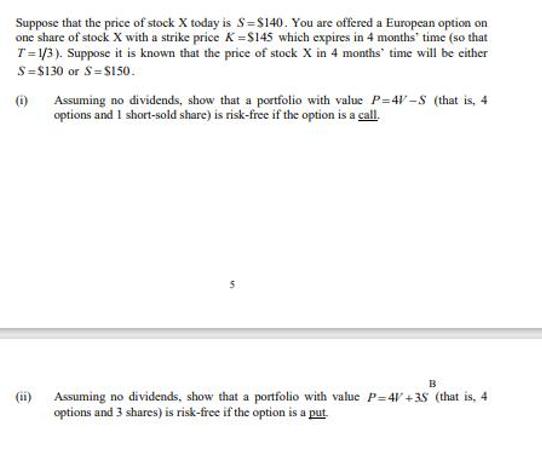

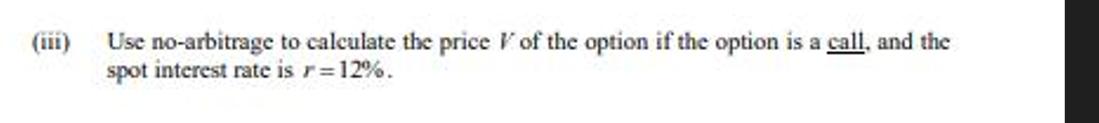

Suppose that the price of stock X today is S-$140. You are offered a European option on one share of stock X with a strike price K-$145 which expires in 4 months' time (so that T=1/3). Suppose it is known that the price of stock X in 4 months' time will be either S=$130 or S=$150. (i) Assuming no dividends, show that a portfolio with value P-4V-S (that is, 4 options and 1 short-sold share) is risk-free if the option is a call. (ii) B Assuming no dividends, show that a portfolio with value P-4V+35 (that is, 4 options and 3 shares) is risk-free if the option is a put (iii) Use no-arbitrage to calculate the price of the option if the option is a call, and the spot interest rate is r=12%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Data Analysis And Decision Making

Authors: Christian Albright, Wayne Winston, Christopher Zappe

4th Edition

538476125, 978-0538476126

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App