Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that the price per share of a company's 5.000.000 outstanding number of shares is exactly $100. But, the valuer of this company predicts that

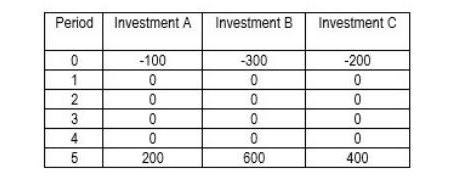

Suppose that the price per share of a company's 5.000.000 outstanding number of shares is exactly $100. But, the valuer of this company predicts that the shares are undervalued by $10. The market value of its interest-bearing debt is estimated at $400 mn, and the average after-tax yield on these liabilities is 10% per year. Tax rate is assumed to be 25%. Assume that the stock of the company is currently paying a dividend of $10 per year. The dividend growth rate is projected to be 10% per year. The company has three independent investment alternatives ahead. The cash flows (in millions of $) associated with these investments are presented in the following table.

With respect to these cash flows, what is the MIRR of Investment C?

With respect to these cash flows, what is the MIRR of Investment C?

Refer to Question above What is the PI of Investment A?

Refer to Question above. If the company has a budget constraint of $300 mn, which investment alternative(s) should it choose?

Period Investment A 0 1 2 345 -100 0 0 0 0 200 Investment B -300 0 0 0 0 600 Investment C -200 0 0 0 0 400

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the MIRR of Investment C we need to first calculate the terminal value of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started