Answered step by step

Verified Expert Solution

Question

1 Approved Answer

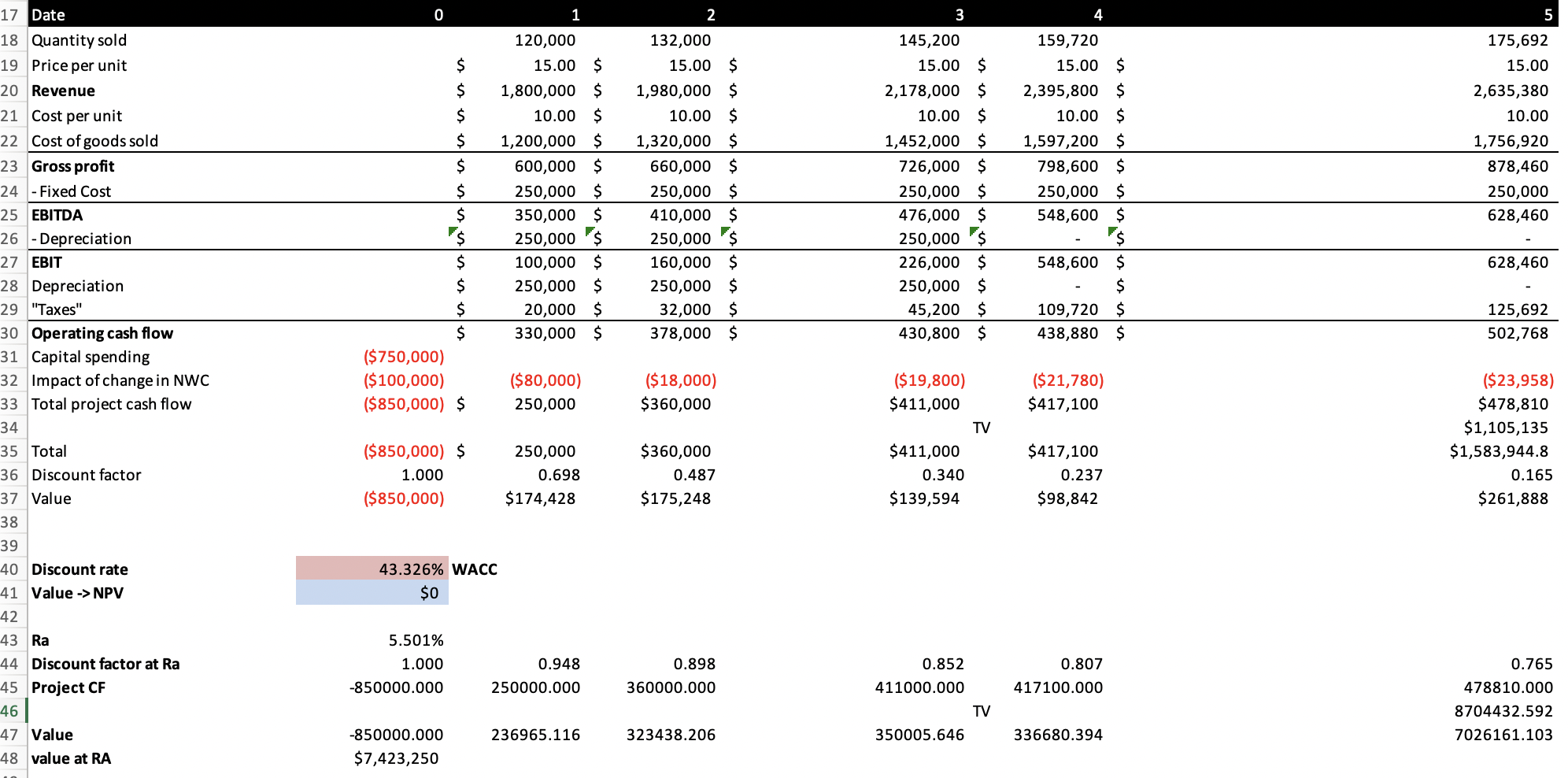

Suppose that the project is undertaken within a newly-formed corporation (perhaps owned by the parent) that has its own balance sheet. At the moment that

Suppose that the project is undertaken within a newly-formed corporation (perhaps owned by the parent) that has its own balance sheet. At the moment that the project commences, what would be (in an efficient market) the total market value, market value of equity, total book value, equity book value, and book/market ratios of this corporation? For simplicity, assume that current liabilities are zero.

17 Date 18 Quantity sold 19 Price per unit 20 Revenue 120,000 1 132,000 2 3 145,200 $ 15.00 $ 15.00 $ 15.00 $ $ 1,800,000 $ 1,980,000 $ 2,178,000 $ 21 Cost per unit $ 10.00 $ 22 Cost of goods sold $ 1,200,000 $ 10.00 $ 1,320,000 10.00 $ 10.00 $ $ 1,452,000 $ 1,597,200 $ 159,720 4 15.00 $ 2,395,800 $ 175,692 15.00 2,635,380 5 10.00 1,756,920 23 Gross profit $ 600,000 $ 660,000 $ 726,000 $ 798,600 $ 878,460 24 Fixed Cost $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 25 EBITDA 26 Depreciation 27 EBIT 28 Depreciation 29 "Taxes" 30 Operating cash flow 31 Capital spending 32 Impact of change in NWC 33 Total project cash flow 34 35 Total $ 350,000 $ 410,000 $ 476,000 $ 548,600 $ 628,460 250,000 $ 250,000 $ 250,000 $ S $ 100,000 $ 160,000 $ 226,000 $ 548,600 $ 628,460 $ 250,000 $ 250,000 $ 250,000 $ $ 20,000 $ 32,000 $ $ 330,000 $ 378,000 $ 45,200 $ 430,800 $ 109,720 $ 125,692 438,880 $ 502,768 ($750,000) ($100,000) ($80,000) ($18,000) ($850,000) $ 250,000 $360,000 ($19,800) $411,000 ($21,780) $417,100 ($23,958) TV $478,810 $1,105,135 ($850,000) $ 250,000 $360,000 $411,000 $417,100 36 Discount factor 37 Value 38 39 1.000 ($850,000) 0.698 $174,428 0.487 $175,248 0.340 $139,594 $98,842 0.237 $1,583,944.8 0.165 $261,888 40 Discount rate 41 Value -> NPV 42 43.326% WACC $0 43 Ra 5.501% 44 Discount factor at Ra 1.000 0.948 0.898 0.852 0.807 45 Project CF -850000.000 250000.000 360000.000 411000.000 417100.000 46 47 Value 48 value at RA TV -850000.000 236965.116 323438.206 $7,423,250 350005.646 336680.394 0.765 478810.000 8704432.592 7026161.103

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started