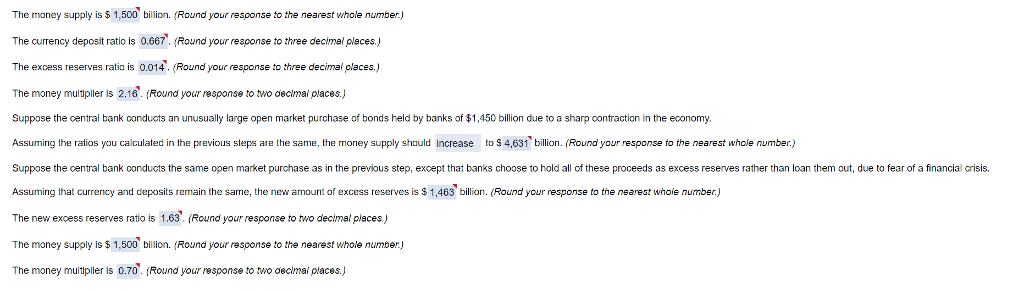

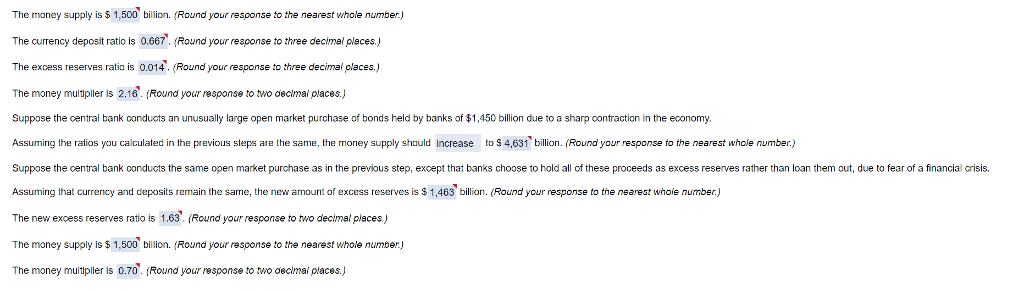

Suppose that the required reserve ratio is %9, Currency in circulation is $580biilion, the amount od checkable deposites is $940 Billion, and excess reserves are $15 billion  j

j

The money supply is 1,500 billion. Round your response to the nearest whole number. The currency deposit ratio is 0.667 (Round your response to three decimal places, The excess reserves ratio is 0.014 (Round your response to three decimal oleces.) he money multiple ls 2.16. (Round your response to two decimal paces. Suppose the central bank conducts an unusually large open market purchase of bonds held by banks of $1,450 billion due to a sharp contraction in the economy. Assuming the ratios you calculated in the previous steps are the same, the money supply should Increase to s 4,631 billion. (Round your response to the nearest whole number Suppose the central bank conducts the same open market purchase as in the previous step, except that banks choose to hold all of these proceeds as excess reserves rather than loan them out, due to fear of a financial crisis. Assuming that currency and deposits remain the same, the new amount of excess reserves is 1,463 billion. Round your response to the nearest whoie number The new excess reserves ratio is 1.63. (Round your response to two decimal places. The money supply is 1,500 billion. Round your response to the nearest whole number) he money multiple s 0.70. (Round your response to two aeclmalplaces. The money supply is 1,500 billion. Round your response to the nearest whole number. The currency deposit ratio is 0.667 (Round your response to three decimal places, The excess reserves ratio is 0.014 (Round your response to three decimal oleces.) he money multiple ls 2.16. (Round your response to two decimal paces. Suppose the central bank conducts an unusually large open market purchase of bonds held by banks of $1,450 billion due to a sharp contraction in the economy. Assuming the ratios you calculated in the previous steps are the same, the money supply should Increase to s 4,631 billion. (Round your response to the nearest whole number Suppose the central bank conducts the same open market purchase as in the previous step, except that banks choose to hold all of these proceeds as excess reserves rather than loan them out, due to fear of a financial crisis. Assuming that currency and deposits remain the same, the new amount of excess reserves is 1,463 billion. Round your response to the nearest whoie number The new excess reserves ratio is 1.63. (Round your response to two decimal places. The money supply is 1,500 billion. Round your response to the nearest whole number) he money multiple s 0.70. (Round your response to two aeclmalplaces

j

j