Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that the six - month interest rate in the United States is 5 % , while the six - month interest rate in Canada

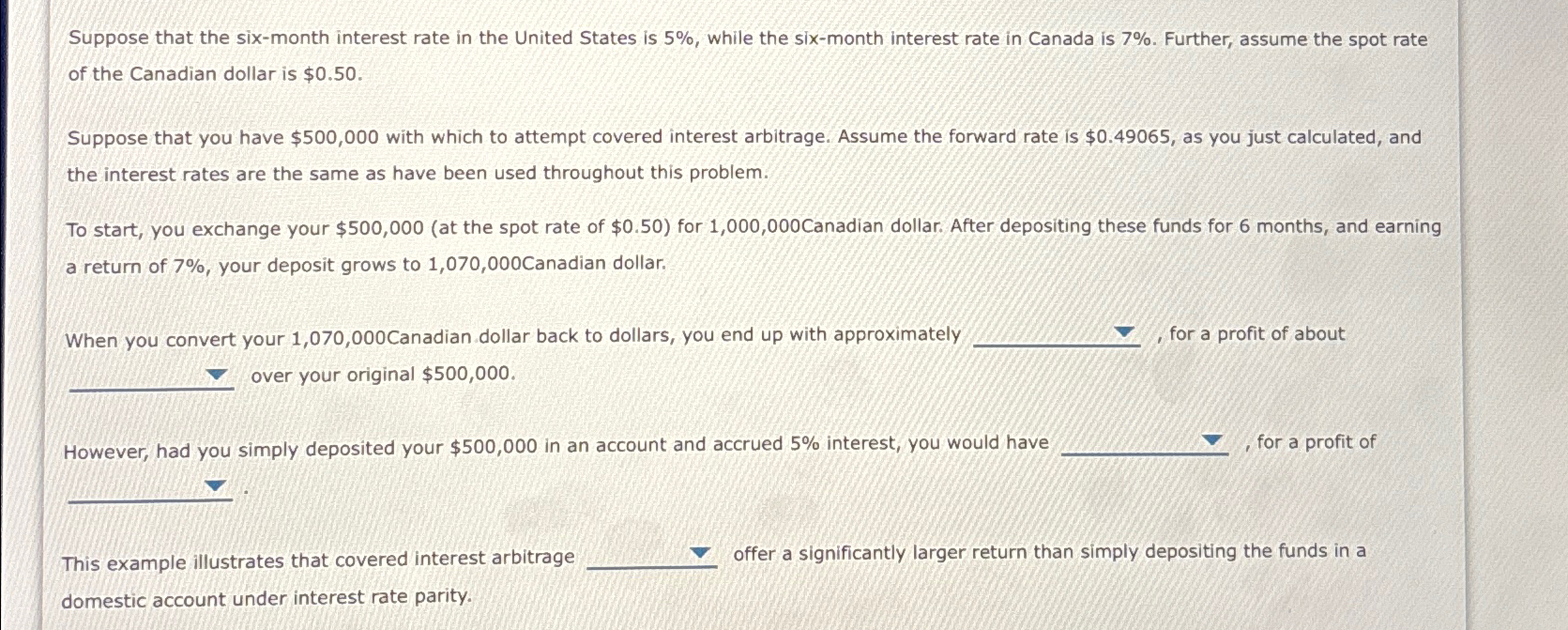

Suppose that the sixmonth interest rate in the United States is while the sixmonth interest rate in Canada is Further, assume the spot rate of the Canadian dollar is $

Suppose that you have $ with which to attempt covered interest arbitrage. Assume the forward rate is $ as you just calculated, and the interest rates are the same as have been used throughout this problem.

To start, you exchange your $at the spot rate of $ for Canadian dollar. After depositing these funds for months, and earning a return of your deposit grows to Canadian dollar.

When you convert your Canadian dollar back to dollars, you end up with approximately for a profit of about over your original $

However, had you simply deposited your $ in an account and accrued interest, you would have for a profit of

This example illustrates that covered interest arbitrage offer a significantly larger return than simply depositing the funds in a domestic account under interest rate parity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started