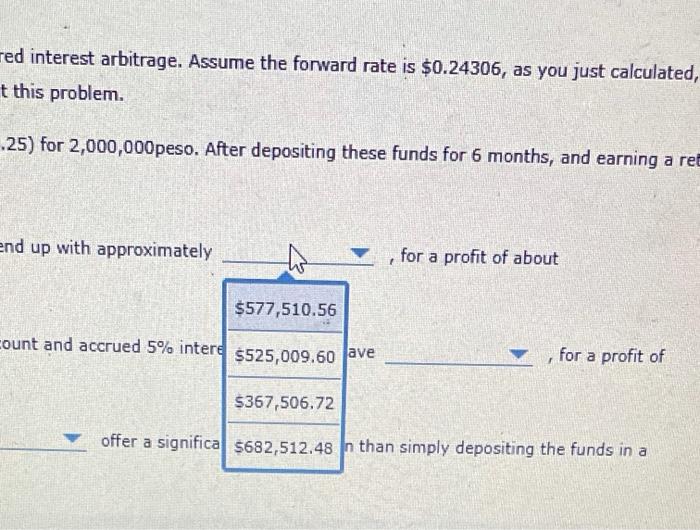

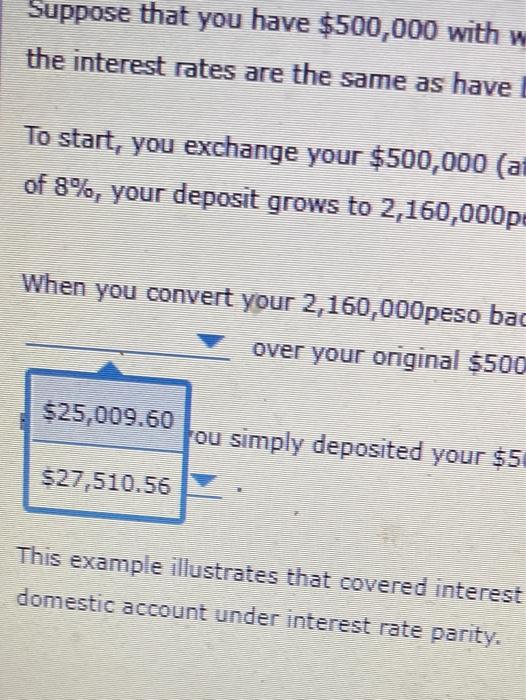

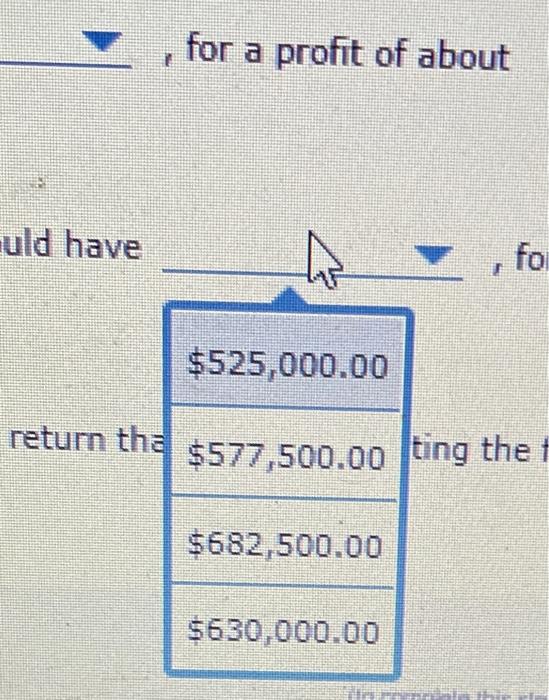

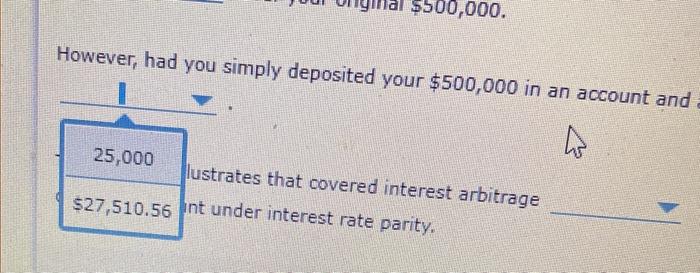

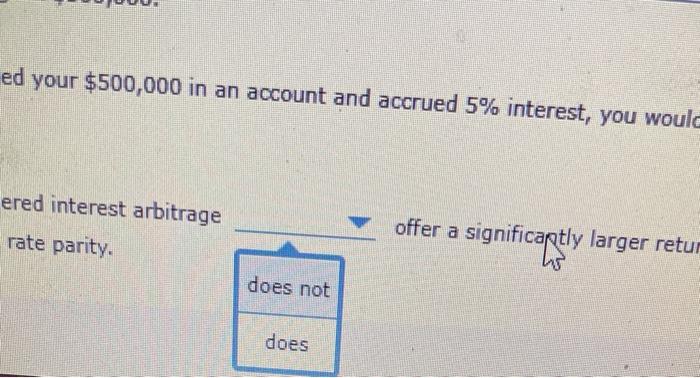

Suppose that the six-month interest rate in the United States is 5%, while the six-month interest rate in Mexico is 8%. Further, assume the spot rate of the peso is $0.25. Suppose that you have $500,000 with which to attempt covered interest arbitrage. Assume the forward rate is $0.24306, as you just calculated, and the interest rates are the same as have been used throughout this problem, To start, you exchange your $500,000 (at the spot rate of $0.25) for 2,000,000peso. After depositing these funds for 6 months, and earning a return of 8%, your deposit grows to 2.160,000peso. for a profit of about When you convert your 2.160,000peso back to dollars, you end up with approximately over your original $500,000. However, had you simply deposited your $500,000 in an account and accrued 5% interest, you would have for a profit of offer a significantly larger return than simply depositing the funds in a This example illustrates that covered interest arbitrage domestic account under interest rate parity red interest arbitrage. Assume the forward rate is $0.24306, as you just calculated, t this problem. 25) for 2,000,000peso. After depositing these funds for 6 months, and earning a ree end up with approximately for a profit of about $577,510.56 count and accrued 5% intere $525,009.60 jave for a profit of 5367,506.72 offer a significa $682,512.48 In than simply depositing the funds in a Suppose that you have $500,000 with w the interest rates are the same as have To start, you exchange your $500,000 (a of 8%, your deposit grows to 2,160,000p When you convert your 2,160,000peso bad over your orginal $500 $25,009.60 You simply deposited your $5 527,510.56 This example illustrates that covered interest domestic account under interest rate parity. for a profit of about uld have fo $525,000.00 return the $577,500.00 (ting the $682,500.00 $630,000.00 $500,000. However, had you simply deposited your $500,000 in an account and w 25,000 lustrates that covered interest arbitrage $27,510.56 Int under interest rate parity, ed your $500,000 in an account and accrued 5% interest, you would ered interest arbitrage rate parity. offer a significantly larger retur a does not does