Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that the total abatement cost function for a firm is C(e) = (3+r)q, where q is the amount of emissions controlled (that is,

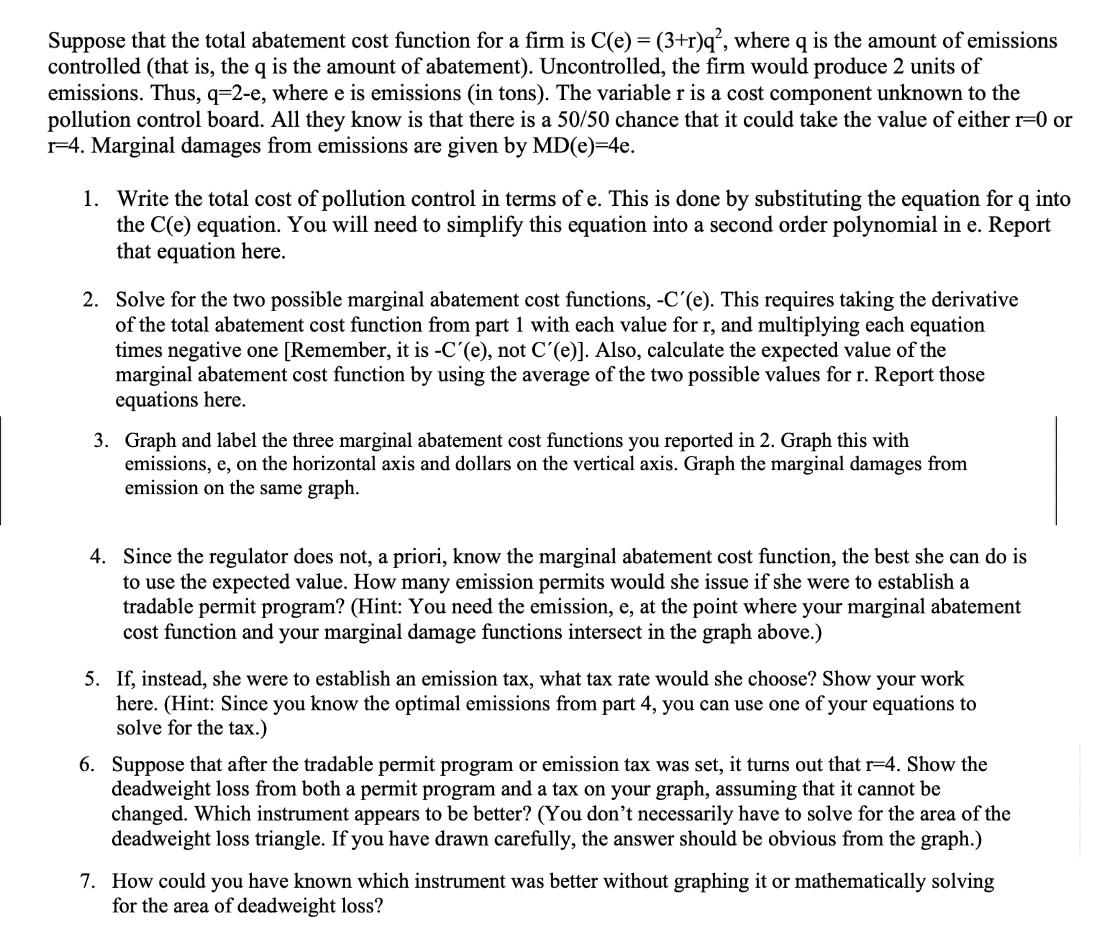

Suppose that the total abatement cost function for a firm is C(e) = (3+r)q, where q is the amount of emissions controlled (that is, the q is the amount of abatement). Uncontrolled, the firm would produce 2 units of emissions. Thus, q=2-e, where e is emissions (in tons). The variable r is a cost component unknown to the pollution control board. All they know is that there is a 50/50 chance that it could take the value of either r=0 or r=4. Marginal damages from emissions are given by MD(e)=4e. 1. Write the total cost of pollution control in terms of e. This is done by substituting the equation for q into the C(e) equation. You will need to simplify this equation into a second order polynomial in e. Report that equation here. 2. Solve for the two possible marginal abatement cost functions, -C'(e). This requires taking the derivative of the total abatement cost function from part 1 with each value for r, and multiplying each equation times negative one [Remember, it is -C'(e), not C'(e)]. Also, calculate the expected value of the marginal abatement cost function by using the average of the two possible values for r. Report those equations here. 3. Graph and label the three marginal abatement cost functions you reported in 2. Graph this with emissions, e, on the horizontal axis and dollars on the vertical axis. Graph the marginal damages from emission on the same graph. 4. Since the regulator does not, a priori, know the marginal abatement cost function, the best she can do is to use the expected value. How many emission permits would she issue if she were to establish a tradable permit program? (Hint: You need the emission, e, at the point where your marginal abatement cost function and your marginal damage functions intersect in the graph above.) 5. If, instead, she were to establish an emission tax, what tax rate would she choose? Show your work here. (Hint: Since you know the optimal emissions from part 4, you can use one of your equations to solve for the tax.) 6. Suppose that after the tradable permit program or emission tax was set, it turns out that r-4. Show the deadweight loss from both a permit program and a tax on your graph, assuming that it cannot be changed. Which instrument appears to be better? (You don't necessarily have to solve for the area of the deadweight loss triangle. If you have drawn carefully, the answer should be obvious from the graph.) 7. How could you have known which instrument was better without graphing it or mathematically solving for the area of deadweight loss?

Step by Step Solution

★★★★★

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

1 To find the total cost of pollution ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started