Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that there are 80 million American Depository Receipts, ADRs, listed on the New York Stock Exchange, NYSE, representing 20 million common shares of

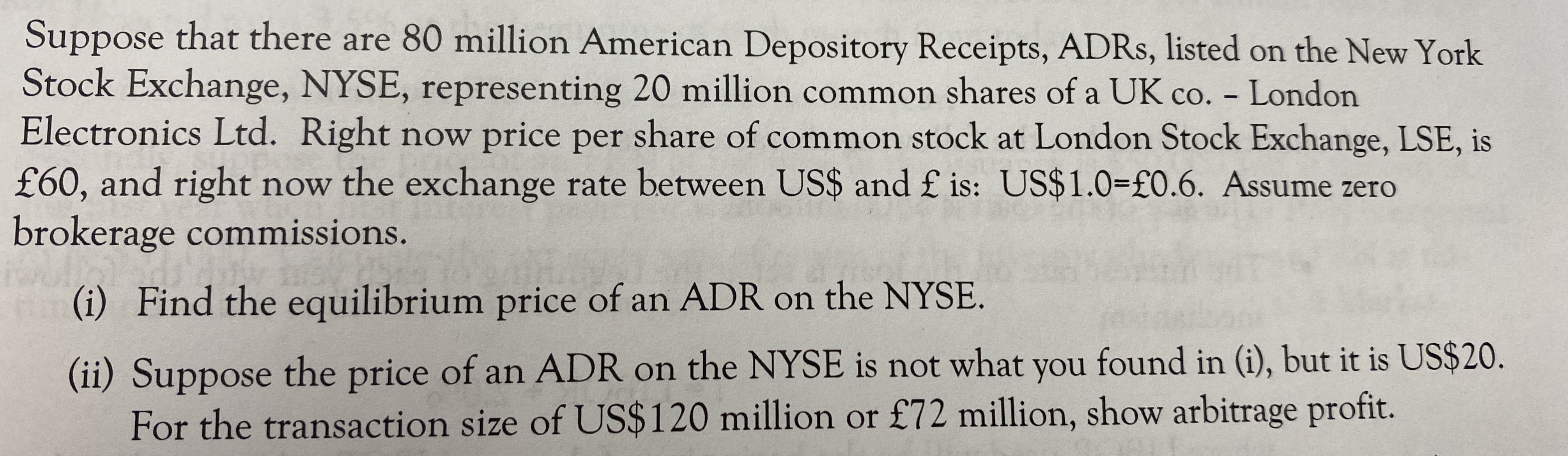

Suppose that there are 80 million American Depository Receipts, ADRs, listed on the New York Stock Exchange, NYSE, representing 20 million common shares of a UK co. - London Electronics Ltd. Right now price per share of common stock at London Stock Exchange, LSE, is 60, and right now the exchange rate between US$ and is: US$1.0-0.6. Assume zero brokerage commissions. (i) Find the equilibrium price of an ADR on the NYSE. (ii) Suppose the price of an ADR on the NYSE is not what you found in (i), but it is US$20. For the transaction size of US$120 million or 72 million, show arbitrage profit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i To find the equilibrium price of an ADR on the NYSE well consider the exchange rate and the number of ADRs representing the common shares Number of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started