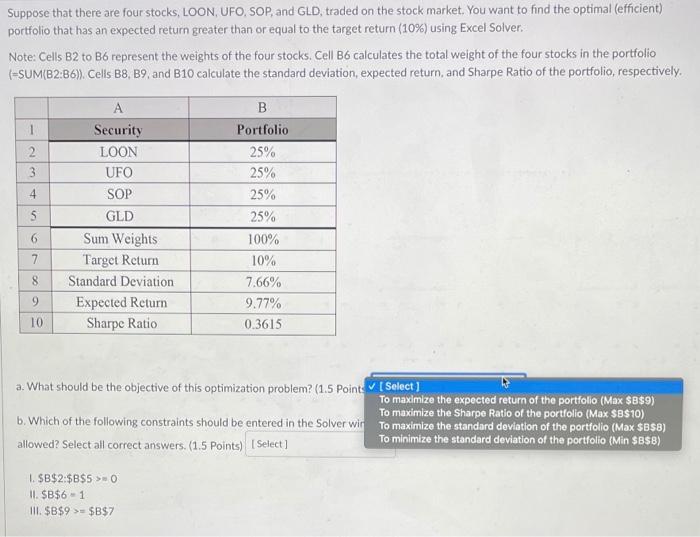

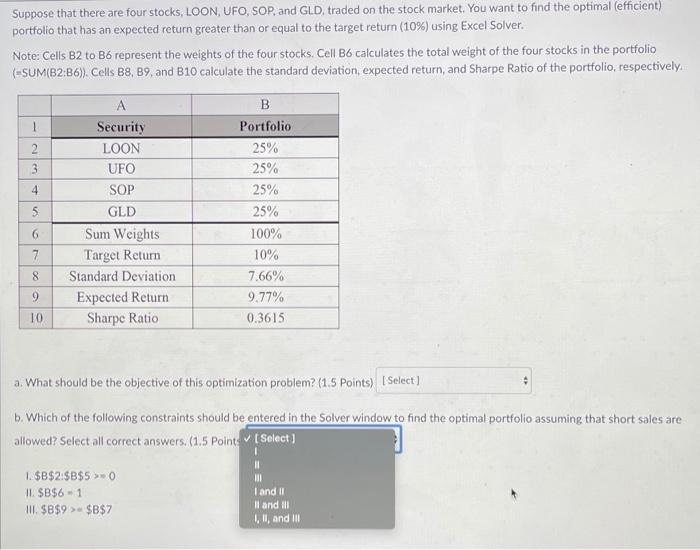

Suppose that there are four stocks, LOON, UFO, SOP, and GLD, traded on the stock market. You want to find the optimal (efficient) portfolio that has an expected return greater than or equal to the target return (10%) using Excel Solver. Note: Cells B2 to B6 represent the weights of the four stocks. Cell B6 calculates the total weight of the four stocks in the portfolio (=SUM(B2:B6)). Cells B8, B9, and B10 calculate the standard deviation, expected return, and Sharpe Ratio of the portfolio, respectively. 1 2 3 4 $ A Security LOON UFO SOP GLD Sum Weights Target Return Standard Deviation Expected Return Sharpe Ratio B Portfolio 25% 25% 25% 25% 100% 10% 7.66% 9.77% 0.3615 6 7 8 9 10 a. What should be the objective of this optimization problem? (1.5 Point Select To maximize the expected return of the portfolio (Max $B$9) To maximize the Sharpe Ratio of the portfolio (Max $B$10) b. Which of the following constraints should be entered in the Solver win To maximize the standard deviation of the portfolio (Max $B$8) allowed? Select all correct answers. (1.5 Points) [Select] To minimize the standard deviation of the portfolio (Min $B$8) I. SB$2:$B$ 50 11. SB$6 - 1 III. $B$9>$B$7 Suppose that there are four stocks, LOON, UFO, SOP, and GLD, traded on the stock market. You want to find the optimal (efficient) portfolio that has an expected return greater than or equal to the target return (10%) using Excel Solver. Note: Cells B2 to B6 represent the weights of the four stocks. Cell B6 calculates the total weight of the four stocks in the portfolio (ESUM(B2:B6). Cells B8, B9, and B10 calculate the standard deviation, expected return, and Sharpe Ratio of the portfolio, respectively. 1 2 3 4 5 A Security LOON UFO SOP GLD Sum Weights Target Return Standard Deviation Expected Return Sharpe Ratio B Portfolio 25% 25% 25% 25% 100% 10% 7.66% 9.77% 0.3615 6 7 8 9 10 a. What should be the objective of this optimization problem? (1.5 points) [Select] b. Which of the following constraints should be entered in the Solver window to find the optimal portfolio assuming that short sales are allowed? Select all correct answers. (1.5 Points Select] 1. $B$2:$B$ 50 II. $B$6 - 1 III. $B$9 > $B$ 7 1 Il I and II Il and Ill I and