Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that there are three dates, t = 0, 1, 2. There are two assets, a long-lived riskless asset and a short-lived risky asset.

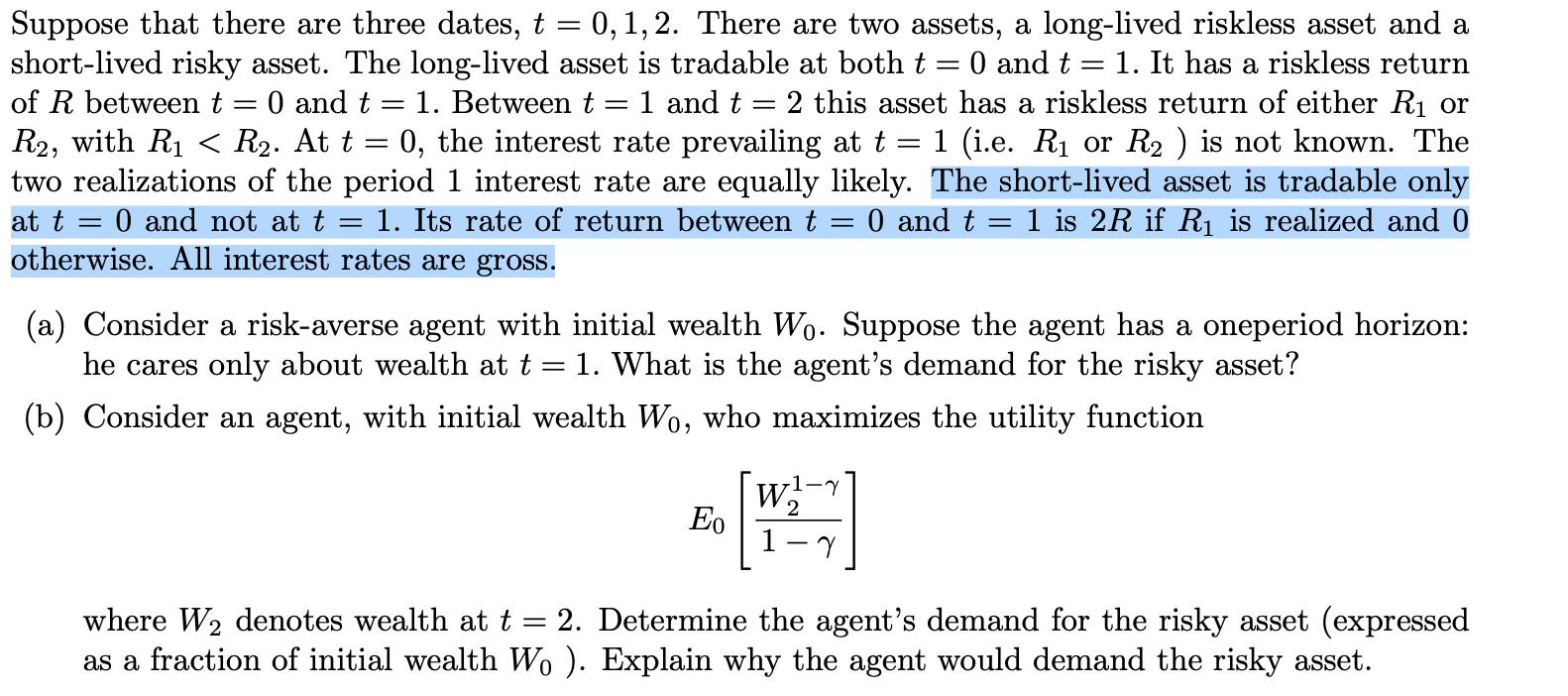

Suppose that there are three dates, t = 0, 1, 2. There are two assets, a long-lived riskless asset and a short-lived risky asset. The long-lived asset is tradable at both t= 0 and t = 1. It has a riskless return of R between t = 0 and t = 1. Between t = 1 and t = 2 this asset has a riskless return of either R or R2, with R R. At t 0, the interest rate prevailing at t 1 (i.e. R or R2 ) is not known. The two realizations of the period 1 interest rate are equally likely. The short-lived asset is tradable only at t = 0 and not at t = 1. Its rate of return between t = 0 and t = 1 is 2R if R is realized and 0 otherwise. All interest rates are gross. = = (a) Consider a risk-averse agent with initial wealth Wo. Suppose the agent has a oneperiod horizon: he cares only about wealth at t = 1. What is the agent's demand for the risky asset? = (b) Consider an agent, with initial wealth Wo, who maximizes the utility function Eo where W denotes wealth at t = 2 W-y 1 Y 2. Determine the agent's demand for the risky asset (expressed as a fraction of initial wealth Wo ). Explain why the agent would demand the risky asset.

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started