Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that today, you buy a 10 percent annual coupon bond for $1,000. The bond has 12 years to maturity. Three years from now, the

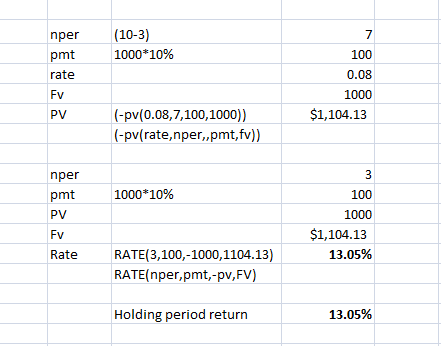

Suppose that today, you buy a 10 percent annual coupon bond for $1,000. The bond has 12 years to maturity. Three years from now, the yield-to-maturity has declined to 8 percent and you decide to sell. What is your annual return for the holding period? Please show equations and all work.

Someone gave this answer, however, this is simply the financial calculator in excel. I need to know how to figure out the answer using the financial formulas. What is the equation and how do you solve them?

Thanks!

7 nper pmt rate (10-3) 1000*10% 100 FV 0.08 1000 $1,104.13 PV (-pv(0.08,7,100,1000)) (-pv(rate, nper,,pmt, fv)) 3 nper pmt PV 1000*10% 100 FV 1000 $1,104.13 13.05% Rate RATE(3,100,-1000,1104.13) RATE(nper,pmt, pv,FV) Holding period return 13.05%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started