Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that Warner Co is a U.S.-based MNC with a major subsidiary in France. This French subsidiary deals in euros, and is expected to

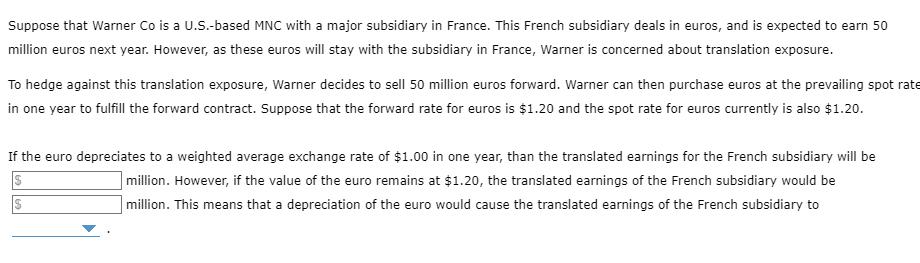

Suppose that Warner Co is a U.S.-based MNC with a major subsidiary in France. This French subsidiary deals in euros, and is expected to earn 50 million euros next year. However, as these euros will stay with the subsidiary in France, Warner is concerned about translation exposure. To hedge against this translation exposure, Warner decides to sell 50 million euros forward. Warner can then purchase euros at the prevailing spot rate in one year to fulfill the forward contract. Suppose that the forward rate for euros is $1.20 and the spot rate for euros currently is also $1.20. If the euro depreciates to a weighted average exchange rate of $1.00 in one year, than the translated earnings for the French subsidiary will be S million. However, if the value of the euro remains at $1.20, the translated earnings of the French subsidiary would be million. This means that a depreciation of the euro would cause the translated earnings of the French subsidiary to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started