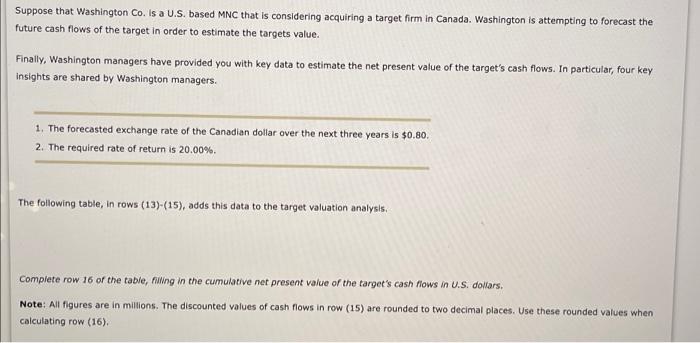

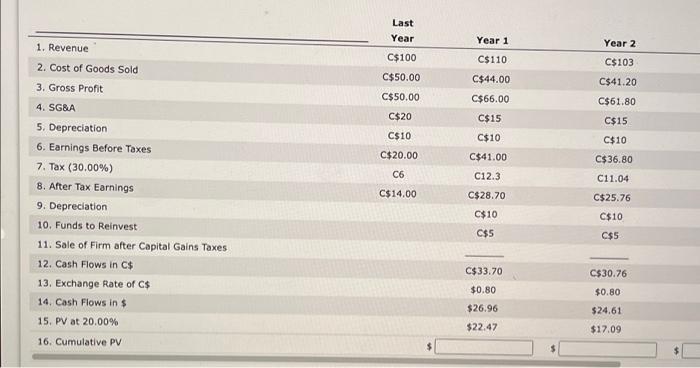

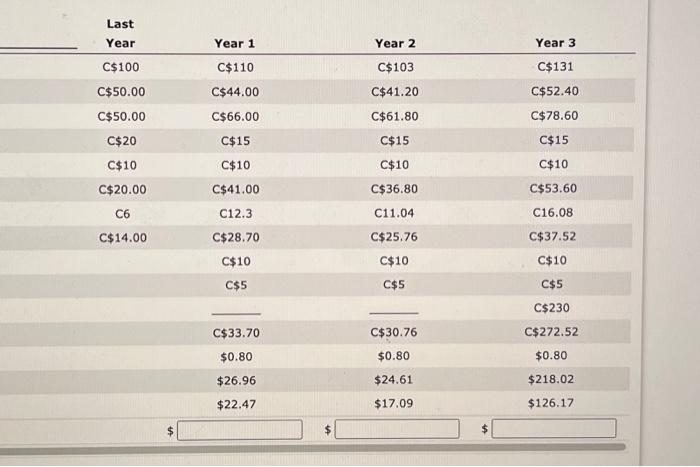

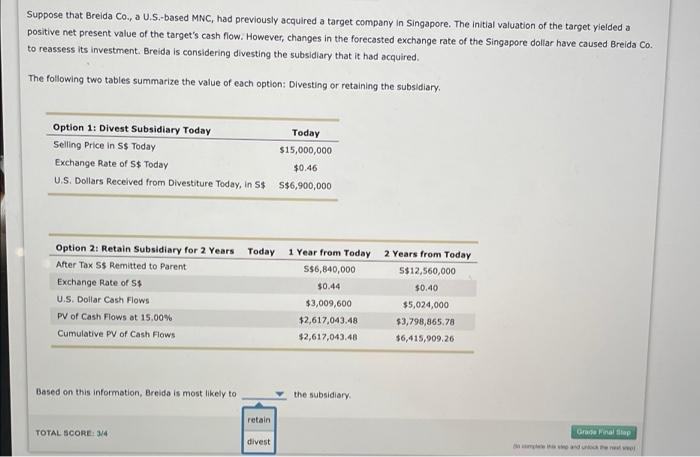

Suppose that Washington Co. Is a U.S. based MNC that is considering acquiring a target firm in Canada. Washington is attempting to forecast the future cash flows of the target in order to estimate the targets value. Finally, Washington managers have provided you with key data to estimate the net present value of the target's cash flows. In particular, four key Insights are shared by Washington managers. 1. The forecasted exchange rate of the Canadian dollar over the next three years is $0.80. 2. The required rate of return is 20.00%. The following table, in rows (13)-(15), adds this data to the target valuation analysis Complete row 16 of the table, hiling in the cumulative net present value of the target's cash flows in U.S. dollars. Note: All figures are in millions. The discounted values of cash flows in row (15) are rounded to two decimal places. Use these rounded values when calculating row (16). Last Year Year 1 1. Revenue Year 2 C$100 C$110 C$103 2. Cost of Goods Sold 3. Gross Profit C$50.00 C$44.00 C$41.20 C$50.00 C$66.00 C$61.80 C$15 C$20 C$10 C$15 C$10 C$10 C$20.00 C$36.80 C$41.00 C12.3 C6 C11.04 C$14.00 C$28.70 C$25.76 4. SG&A 5. Depreciation 6. Earnings Before Taxes 7. Tax (30.00%) 8. After Tax Earnings 9. Depreciation 10. Funds to Reinvest 11. Sale of Firm after Capital Gains Taxes 12. Cash Flows in C$ 13. Exchange Rate of C$ 14. Cash Flows in $ 15. PV at 20.00% C$10 C$10 C$s C$5 C$33.70 C$30.76 $0.80 $0.80 $26.96 $24.61 $22.47 $17.09 16. Cumulative PV Last Year Year 1 Year 2 Year 3 C$103 C$100 C$50.00 C$50.00 C$131 C$52.40 C$41.20 C$110 C$44.00 C$66.00 C$15 C$61.80 C$78.60 C$15 C$20 C$15 C$10 C$10 C$10 C$10 C$20.00 C$41.00 C$36.80 C$53.60 C6 C12.3 C11.04 C16.08 C$14.00 C$28.70 C$37.52 C$25.76 C$10 C$10 C$5 C$10 C$5 C$5 C$230 C$33.70 C$272.52 C$30.76 $0.80 $0.80 $0.80 $26.96 $24.61 $218.02 $126.17 $22.47 $17.09 $ Suppose that Breida Co., a U.S.-based MNC, had previously acquired a target company in Singapore. The initial valuation of the target yielded a positive net present value of the target's cash flow. However, changes in the forecasted exchange rate of the Singapore dollar have caused Breida Co. to reassess its Investment. Breida is considering divesting the subsidiary that it had acquired. The following two tables summarize the value of each option: Divesting or retaining the subsidiary Option 1: Divest Subsidiary Today Today Selling Price in S$ Today $15,000,000 Exchange Rate of S$ Today $0.46 U.S. Dollars Received from Divestiture Today, in S$ S$6,900,000 Today Option 2: Retain Subsidiary for 2 Years After Tax Ss Remitted to Parent Exchange Rate of $ U.S. Dollar Cash Flows PV of Cash Flows at 15.00% Cumulative PV of Cash Flows 1 Year from Today S$6,840,000 $0.44 $3,009,600 $2,617,043.48 $2,617,043.40 2 Years from Today S$12,560,000 $0.40 $5,024,000 $3,798,865.78 $6,415,909.26 Based on this information, Breida is most likely to the subsidiary retain TOTAL SCORE: 3/4 Grand Final Step divest