Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that we invest in a treasury bill that has a par value of $1000 and provides a return of 3.25%. What would be

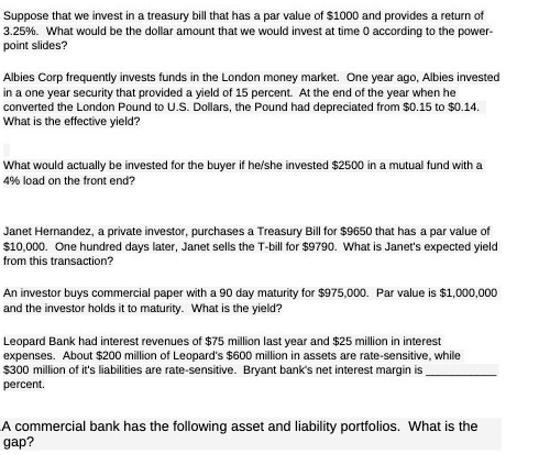

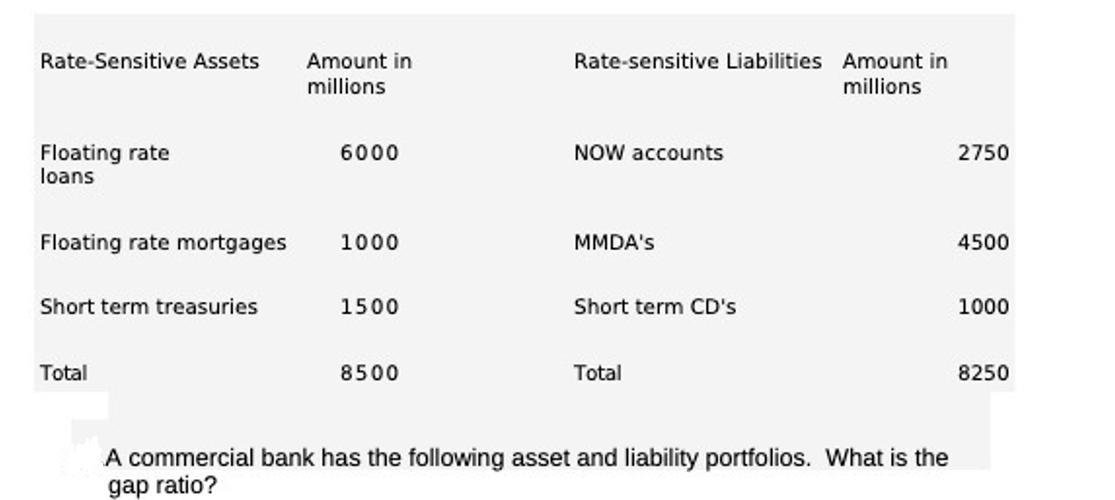

Suppose that we invest in a treasury bill that has a par value of $1000 and provides a return of 3.25%. What would be the dollar amount that we would invest at time 0 according to the power- point slides? Albies Corp frequently invests funds in the London money market. One year ago, Albies invested in a one year security that provided a yield of 15 percent. At the end of the year when he converted the London Pound to U.S. Dollars, the Pound had depreciated from $0.15 to $0.14. What is the effective yield? What would actually be invested for the buyer if he/she invested $2500 in a mutual fund with a 4% load on the front end? Janet Hernandez, a private investor, purchases a Treasury Bill for $9650 that has a par value of $10,000. One hundred days later, Janet sells the T-bill for $9790. What is Janet's expected yield from this transaction? An investor buys commercial paper with a 90 day maturity for $975,000. Par value is $1,000,000 and the investor holds it to maturity. What is the yield? Leopard Bank had interest revenues of $75 million last year and $25 million in interest expenses. About $200 million of Leopard's $600 million in assets are rate-sensitive, while $300 million of it's liabilities are rate-sensitive. Bryant bank's net interest margin is percent. A commercial bank has the following asset and liability portfolios. What is the gap? Rate-Sensitive Assets Floating rate loans Floating rate mortgages Short term treasuries Total Amount in millions 6000 1000 1500 8500 Rate-sensitive Liabilities Amount in millions NOW accounts MMDA's Short term CD's Total A commercial bank has the following asset and liability portfolios. What is the gap ratio? 2750 4500 1000 8250

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Suppose that we invest in a treasury bill that has a par value of 1000 and provides a return of 325 What would be the dollar amount that we would inve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started