Question

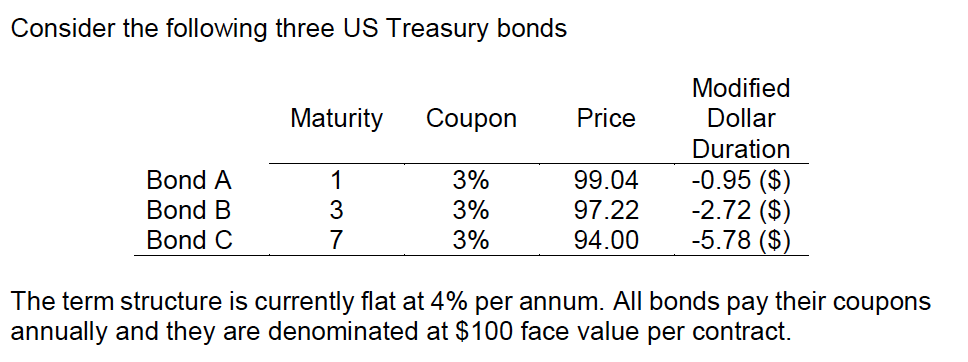

Suppose that we would like to buy one of the three bonds for a holding period of 1 year. We anticipate the term structure to

| Suppose that we would like to buy one of the three bonds for a holding period of 1 year. We anticipate the term structure to rise to a flat 5% by the end of the year. Briefly discuss which bond we should buy and why. | |

| (ii) | Construct a simple butterfly strategy using bonds A, B and C. Briefly discuss the objectives of this strategy. |

| (iii) | Without any further calculations, briefly discuss how a 50-50 weighted butterfly and a regression-weighted butterfly would differ from the simple butterfly in (ii). |

| (iv) | Suppose that a US T-bond futures contract has just been issued, and bonds A, B and C are eligible for delivery. Compute the conversion factor for each bond.

|

| (v) | Without any further calculations, briefly discuss how we would compute the Cheapest-To-Deliver bond with respect to the futures contract in (iv). |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started