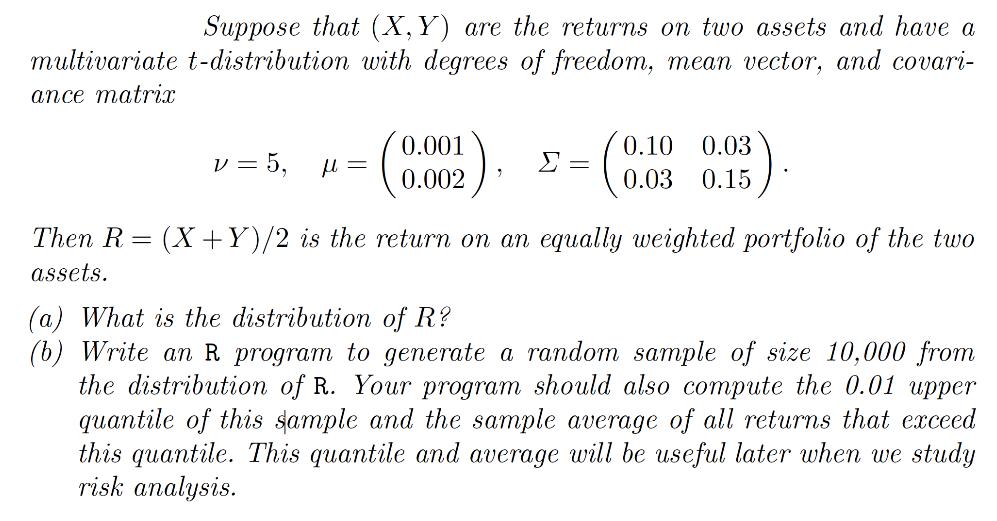

Suppose that (X,Y) are the returns on two assets and have a multivariate t-distribution with degrees of freedom, mean vector, and covari- ance matrix

Suppose that (X,Y) are the returns on two assets and have a multivariate t-distribution with degrees of freedom, mean vector, and covari- ance matrix V = 5, = 0.001 0.002 = 0.03 0.10 0.03 0.15 Then R= (X+Y)/2 is the return on an equally weighted portfolio of the two assets. (a) What is the distribution of R? (b) Write an R program to generate a random sample of size 10,000 from the distribution of R. Your program should also compute the 0.01 upper quantile of this sample and the sample average of all returns that exceed this quantile. This quantile and average will be useful later when we study risk analysis.

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the distribution of R we need to calculate its mean and var...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started