Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that you are a fixed income portfolio manager at Bourbon Street Capital. You have the following bonds issued by Royal, Inc. and Chartres,

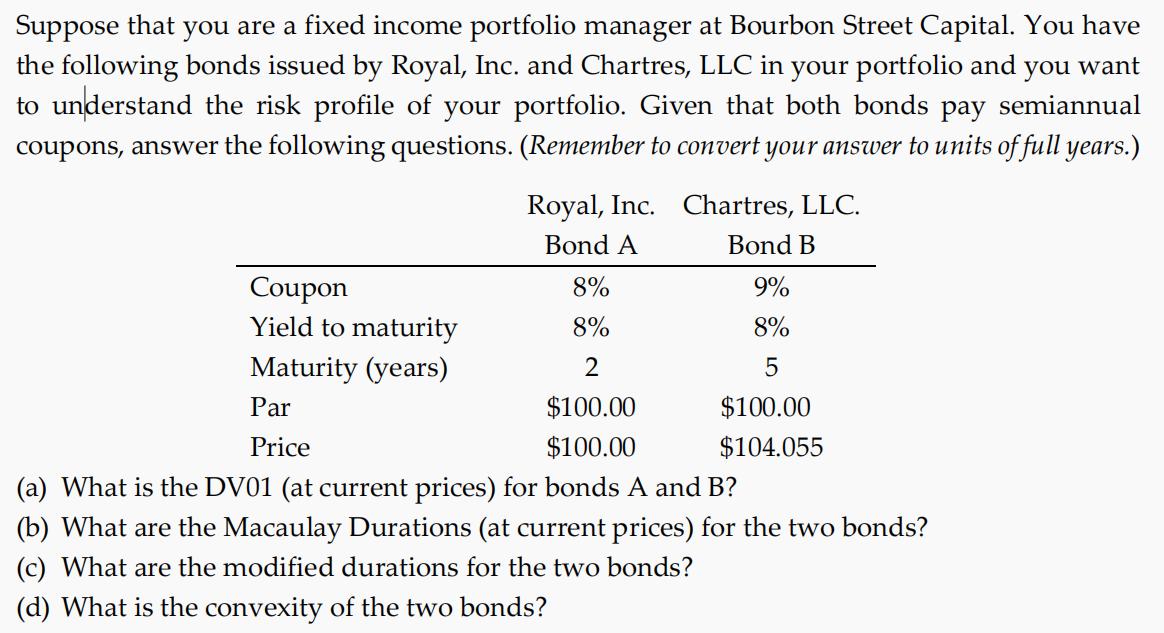

Suppose that you are a fixed income portfolio manager at Bourbon Street Capital. You have the following bonds issued by Royal, Inc. and Chartres, LLC in your portfolio and you want to understand the risk profile of your portfolio. Given that both bonds pay semiannual coupons, answer the following questions. (Remember to convert your answer to units of full years.) Royal, Inc. Chartres, LLC. Bond A Bond B 8% 8% 2 Par $100.00 Price $100.00 (a) What is the DV01 (at current prices) for bonds A and B? (b) What are the Macaulay Durations (at current prices) for the two bonds? (c) What are the modified durations for the two bonds? (d) What is the convexity of the two bonds? Coupon Yield to maturity Maturity (years) 9% 8% 5 $100.00 $104.055

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the DV01 Macaulay Duration Modified Duration and Convexity we need to know the bond prices coupon rates yield to maturity and time to mat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started