Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that you are a speculator that anticipates a depreciation of the Singapore dollar (S$). You purchase a put option contract on Singapore dollars. Each

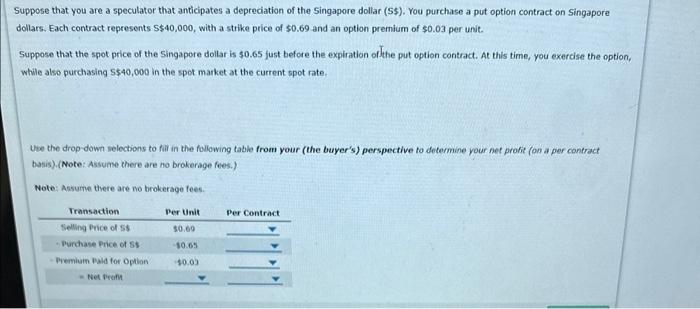

Suppose that you are a speculator that anticipates a depreciation of the Singapore dollar (S$). You purchase a put option contract on Singapore dollars. Each contract represents S$40,000, with a strike price of $0.69 and an option premium of $0.03 per unit. Suppose that the spot price of the Singapore dollar is $0.65 just before the expiration of the put option contract. At this time, you exercise the option, while also purchasing $$40,000 in the spot market at the current spot rate. Use the drop-down selections to fill in the following table from your (the buyer's) perspective to determine your net profit (on a per contract basis). (Note: Assume there are no brokerage fees.) Note: Assume there are no brokerage fees. Transaction Selling Price of S$ Purchase Price of S$ Premium Paid for Option = Net Profit Per Unit $0.69 -$0.65 -$0.03 Per Contract

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started