Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that you are considering investing in three mutual funds. The first is a U . S . stock fund, the second is an emerging

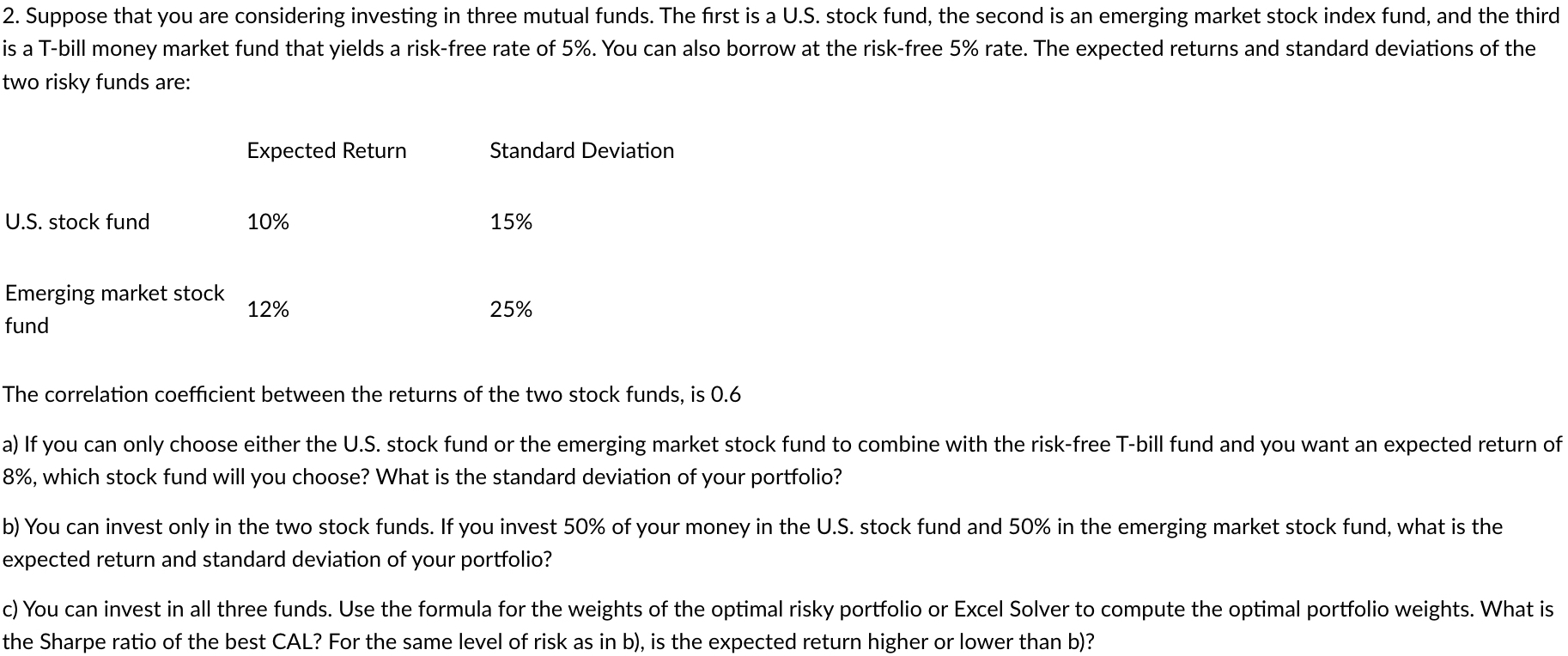

Suppose that you are considering investing in three mutual funds. The first is a US stock fund, the second is an emerging market stock index fund, and the third

is a Tbill money market fund that yields a riskfree rate of You can also borrow at the riskfree rate. The expected returns and standard deviations of the

two risky funds are:

Expected Return

US stock fund

Emerging market stock

fund

Standard Deviation

The correlation coefficient between the returns of the two stock funds, is

a If you can only choose either the US stock fund or the emerging market stock fund to combine with the riskfree Tbill fund and you want an expected return of

which stock fund will you choose? What is the standard deviation of your portfolio?

b You can invest only in the two stock funds. If you invest of your money in the US stock fund and in the emerging market stock fund, what is the

expected return and standard deviation of your portfolio?

c You can invest in all three funds. Use the formula for the weights of the optimal risky portfolio or Excel Solver to compute the optimal portfolio weights. What is

the Sharpe ratio of the best CAL? For the same level of risk as in b is the expected return higher or lower than b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started