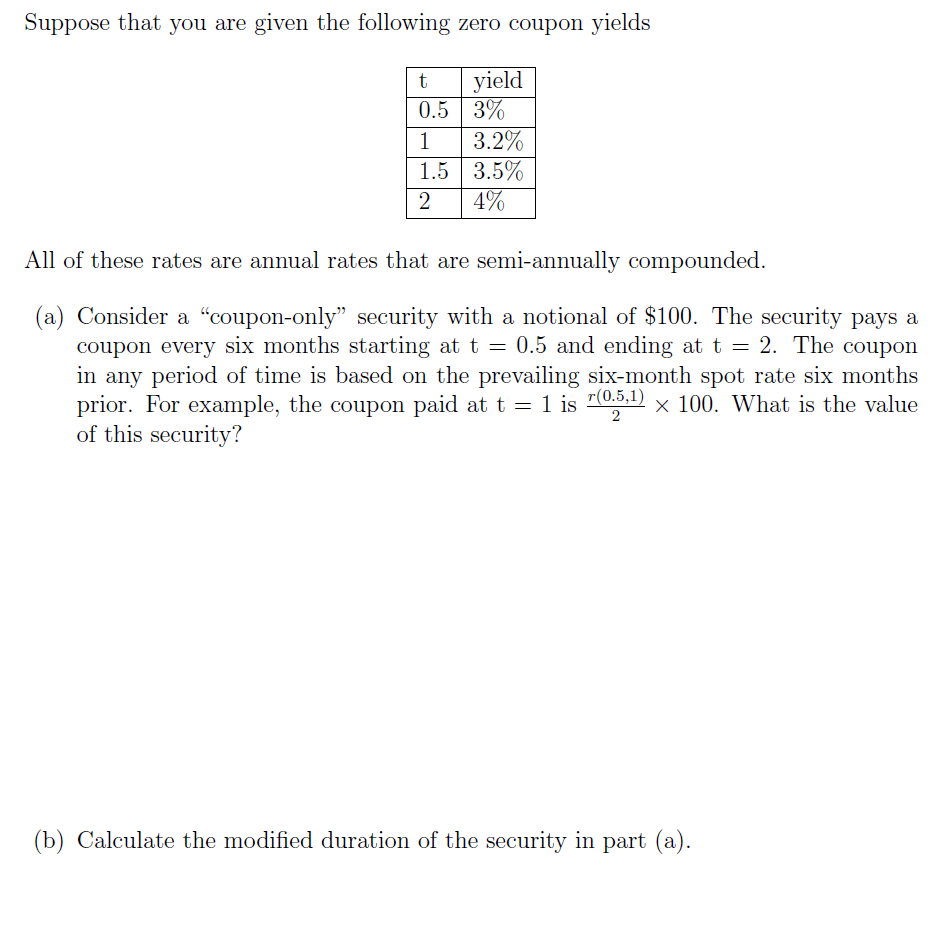

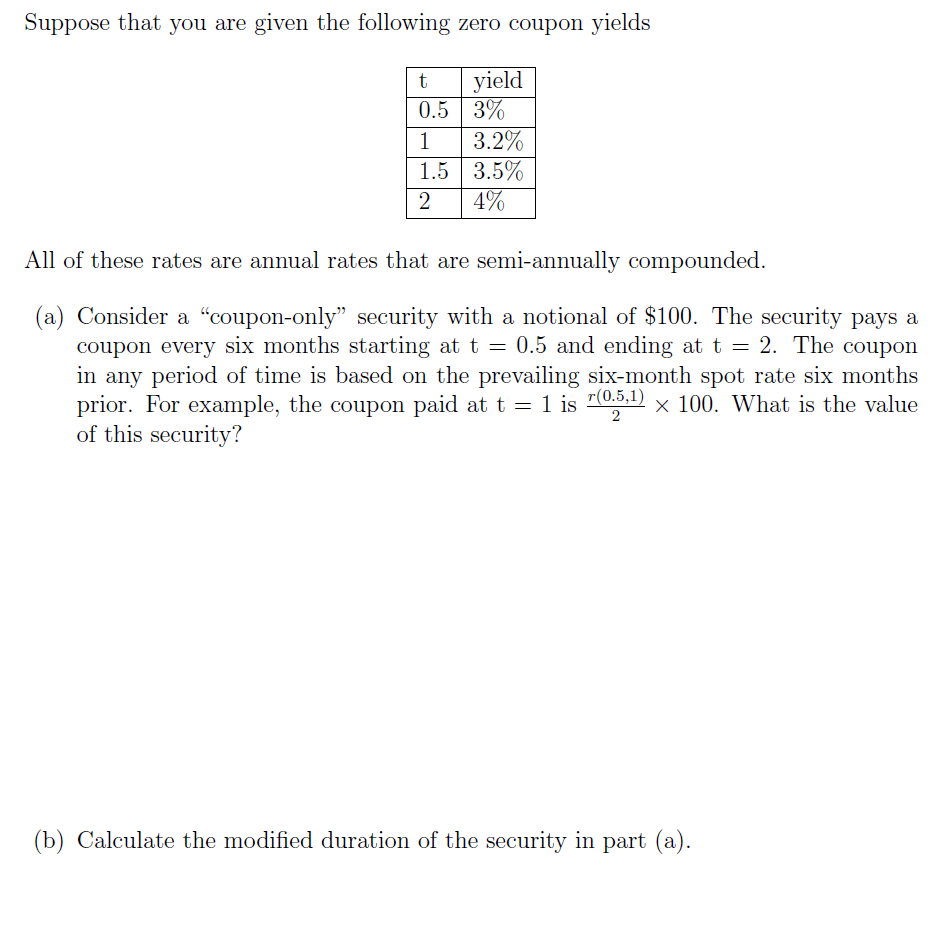

Suppose that you are given the following zero coupon yields t yield 0.5 3% 1 3.2% 1.5 3.5% 24% All of these rates are annual rates that are semi-annually compounded. (a) Consider a coupon-only" security with a notional of $100. The security pays a coupon every six months starting at t = 0.5 and ending at t = 2. The coupon in any period of time is based on the prevailing six-month spot rate six months prior. For example, the coupon paid at t = 1 is 7(0.5,1) x 100. What is the value of this security? (b) Calculate the modified duration of the security in part (a). (c) Suppose that the security in (a) is a liability and you want to hedge against small interest rate changes. The two securities available to you are a 1-year zero coupon bond and a 2-year zero coupon bond and in addition to hedging against small interest rate changes, you also want to set-up the portfolio so that the value of your assets is equal to the value of your liabilities. Set-up the equations needed to solve for positions in the 1-year and 2-year zero coupon bonds. You do not need to solve the equations. (d) Suppose that you believe that all of the current interest rates provided in this problem are too high and will decrease in the near future. Thus, you decide to enter into an interest rate swap today in the hopes of making money if interest rates drop. Would you want to pay fixed or pay floating in the interest rate swap you enter into today? Explain why. Suppose that you are given the following zero coupon yields t yield 0.5 3% 1 3.2% 1.5 3.5% 24% All of these rates are annual rates that are semi-annually compounded. (a) Consider a coupon-only" security with a notional of $100. The security pays a coupon every six months starting at t = 0.5 and ending at t = 2. The coupon in any period of time is based on the prevailing six-month spot rate six months prior. For example, the coupon paid at t = 1 is 7(0.5,1) x 100. What is the value of this security? (b) Calculate the modified duration of the security in part (a). (c) Suppose that the security in (a) is a liability and you want to hedge against small interest rate changes. The two securities available to you are a 1-year zero coupon bond and a 2-year zero coupon bond and in addition to hedging against small interest rate changes, you also want to set-up the portfolio so that the value of your assets is equal to the value of your liabilities. Set-up the equations needed to solve for positions in the 1-year and 2-year zero coupon bonds. You do not need to solve the equations. (d) Suppose that you believe that all of the current interest rates provided in this problem are too high and will decrease in the near future. Thus, you decide to enter into an interest rate swap today in the hopes of making money if interest rates drop. Would you want to pay fixed or pay floating in the interest rate swap you enter into today? Explain why